Featured

Can I File Late Taxes Online

According to IRSgov there is no penalty assessed on taxpayers who are due a return but do not file on time. If you are experiencing difficulty preparing your return you may be eligible for assistance through the Volunteer Income Tax Assistance VITA or the Tax Counseling for the Elderly TCE programs.

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

You can also file IRS Form 9465 the Installment Agreement Request with your tax return regardless of how much you owe.

Can i file late taxes online. The penalty for not filing taxes depends on whether you owe taxes to the IRS. If youre really late in filing though like lets say three years late your unclaimed refund may disappear. If you owe less than that amount you can request an installment agreement online for a fee.

Filing for the extension wipes out the penalty. Online preparation and e-filing for 2017 2018 and 2019 is permanently closed. You can always search through the IRS website for the forms but for quicker access you should use sophisticated tax preparation software such as TurboTax.

You can get expert help filing back tax. However what happens if you file taxes lateor not at allis. That penalty applies for each month or.

Prepare your back tax returns. So for example in 2021 you can file back taxes for years 2017 2018 and 2019. Your request should most likely be automatically approved if you owe less than 10000.

Waiting until the IRS files a substitute return for them will only complicate matters further and add to their tax bill. Get our online tax forms and instructions to file your past due return or order them by calling 1-800-Tax-Form 1-800-829-3676 or 1-800-829-4059 for TTYTDD. You can still prepare and efile a 2017 return with TurboTax.

Then click on the Prior Years tab in the middle of the My Account page. If you do not pay your taxes by the tax deadline you normally will face a failure-to-pay penalty of ½ of 1 percent of your unpaid taxes. Filing late tax returns The biggest issue in getting a late tax return filed electronically is that many people do not understand the technical details that are involved.

In short yes you can file your late tax return online and it is better to look into it as soon as you can if you want to save money. 5 of your balance owing plus 1 of your balance owing for each month the return is late up to a maximum of 12 months. However you might not receive any tax refunds since they generally expire after three years.

Not filing a required return is a serious issue with the IRS. No its not too late to file a 2017 return. If you dont file the IRS can file a return for you with taxes and penalties.

Filing a late return can be a daunting task but taxpayers can minimize the damage by completing and filing an accurate return as soon as possible. The current online program can only be used for a 2020 return--no other year. If youre more than 60 days late the minimum penalty is 100 or 100 of the tax due with the return whichever is less.

It turns out that as long as the IRS owes you money on your federal taxes you wont be subject to a penalty for late filing whether or not you asked for an extension. That penalty starts accruing the day after the tax filing due date and will not exceed 25 percent of your unpaid taxes. But if you owe Federal taxes you could have a late filing penalty and a failure-to-pay penalty.

You can use TaxSlayer to file a return for up to three years after it is due. And if you did not file a 2019 return you will have trouble e-filing 2020. The penalty for filing late is normally 5 percent of the unpaid taxes for each month or part of a month that a tax return is late.

However you should be aware of the consequences of filing a late tax return and even knowing what the consequences are will not help you decide to file a late tax return. You can file your taxes late without tax penalties and even collect your refund for up to 3 years after your tax-filing deadline. You can use the IRS online tracking tool to check the status of your refund.

Generally if you meet filing requirements you need to file a tax return for this year and the past six years but the IRS may request a tax return older than six years. Learn more in this article. It is never too late to file your tax returns even if you have not filed for several years.

You can submit a late tax return using the same methods you would use to file your return on time. You can turn in your taxes using tax preparation software mailing a return prepared by a tax preparer or completing the CRAs General Income Tax and Benefit Package and submitting it. TurboTax Easy Extension is a fast and easy way to file your extension right from your computer.

Individual income tax filers including sole proprietors and partners who file their tax late and have a balance owing to the Canada Revenue Agency CRA will be subject to a late filing penalty which is. Simply log into your account or create a new account to begin. The governments program to provide electronic returns to taxpayers has made things a little more complicated than in the past.

There is no penalty for a late Federal return if you are due a Federal refund. If thats the case focus instead on filing your late tax returns as soon as possible so you can get caught up and protect your refunds in the future. If zero does not work then you have to print sign and mail 2020.

You must always file your back tax returns on the original forms for each tax year you are filing. You should take special care when preparing and filing late returns because the IRS gives them extra scrutiny. If you havent filed taxes for several years or if youve never filed taxes you can still file a late return.

When it asks for your 2019 AGI try using zero.

Late Filing Or Late Payment Penalties Missed Deadline 2021

Late Filing Or Late Payment Penalties Missed Deadline 2021

:strip_icc()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif) When Is The Earliest You Can File Your Tax Return

When Is The Earliest You Can File Your Tax Return

Filing Your Taxes Late Turbotax Tax Tips Videos

Filing Your Taxes Late Turbotax Tax Tips Videos

2021 Canada Tax Filing Deadline And What You Need To Know

2021 Canada Tax Filing Deadline And What You Need To Know

File Taxes Online E File Federal And State Returns 1040 Com Filing Taxes Diy Taxes Finance Blog

File Taxes Online E File Federal And State Returns 1040 Com Filing Taxes Diy Taxes Finance Blog

/us-tax-forms-88160317-5a2cc956482c520037018723.jpg) Filing A Late Tax Return And Protecting Your Refunds

Filing A Late Tax Return And Protecting Your Refunds

What To Do If You Re Late Filing Taxes

What To Do If You Re Late Filing Taxes

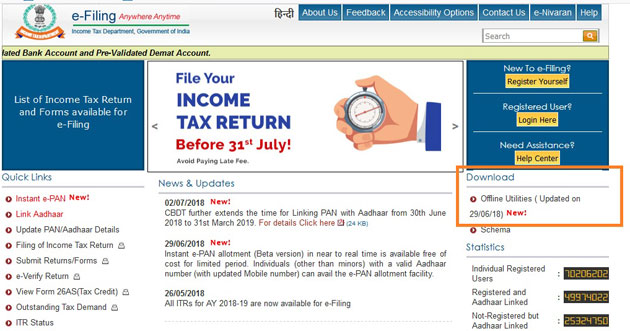

Itr Filing Last Date Do Not Ignore This Avoid Late Fee By Filing Income Tax Returns Online Step By Step Guide

Itr Filing Last Date Do Not Ignore This Avoid Late Fee By Filing Income Tax Returns Online Step By Step Guide

No Self Assessment Late Filing Penalty For Those Who File Online By 28 February North East Bic

No Self Assessment Late Filing Penalty For Those Who File Online By 28 February North East Bic

Can I File My 2009 Taxes Online Priortax

Can I File My 2009 Taxes Online Priortax

Itr E Filing E Filing Income Tax Return How Individuals Can Upload Any Itr Using Excel Utility

Itr E Filing E Filing Income Tax Return How Individuals Can Upload Any Itr Using Excel Utility

Tax Extension Form 4868 E File By May 17 2021

Tax Extension Form 4868 E File By May 17 2021

How To File Prior Year Taxes Online Priortax

How Do I File Back Tax Returns Turbotax Tax Tips Videos

How Do I File Back Tax Returns Turbotax Tax Tips Videos

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment