Featured

Variable Annuity Pros And Cons

Of course nothing in the investment world is free and these features come at a cost. Although variable annuities carry the potential of higher returns than fixed annuities they dont offer a guaranteed payout.

Variable Annuities What They Are Why They Re A Bad For Most Investors

Variable Annuities What They Are Why They Re A Bad For Most Investors

In fact in 2018 Americans bought almost 93 billion of variable annuities.

Variable annuity pros and cons. Variable annuities give the contract holder periodic payments for the rest of his or her life which protects against the possibility of outliving other assets. If you are purchasing an annuity with high fees there had better be compelling reasons to do so. What it means for you is that you will pay no taxes on investment income until they withdraw your money.

The Pros and Cons They can end up generating significant taxes. Variable Annuity Pros and Cons. Some annuity products are commission-free low cost and without surrender charges.

Variable annuities accumulate money on a tax-deferred basis. They are so complex that many who own them dont understand them. A variable annuity like ALL other annuities offer a guaranteed payment of income for the life of the annuitant who may be different from the contract owner.

You are able to defer taxable income into the future. Here you can pay once or in a series. The growth in the subaccount investments capital gains and dividends arent taxed until money is taken out of the variable annuity.

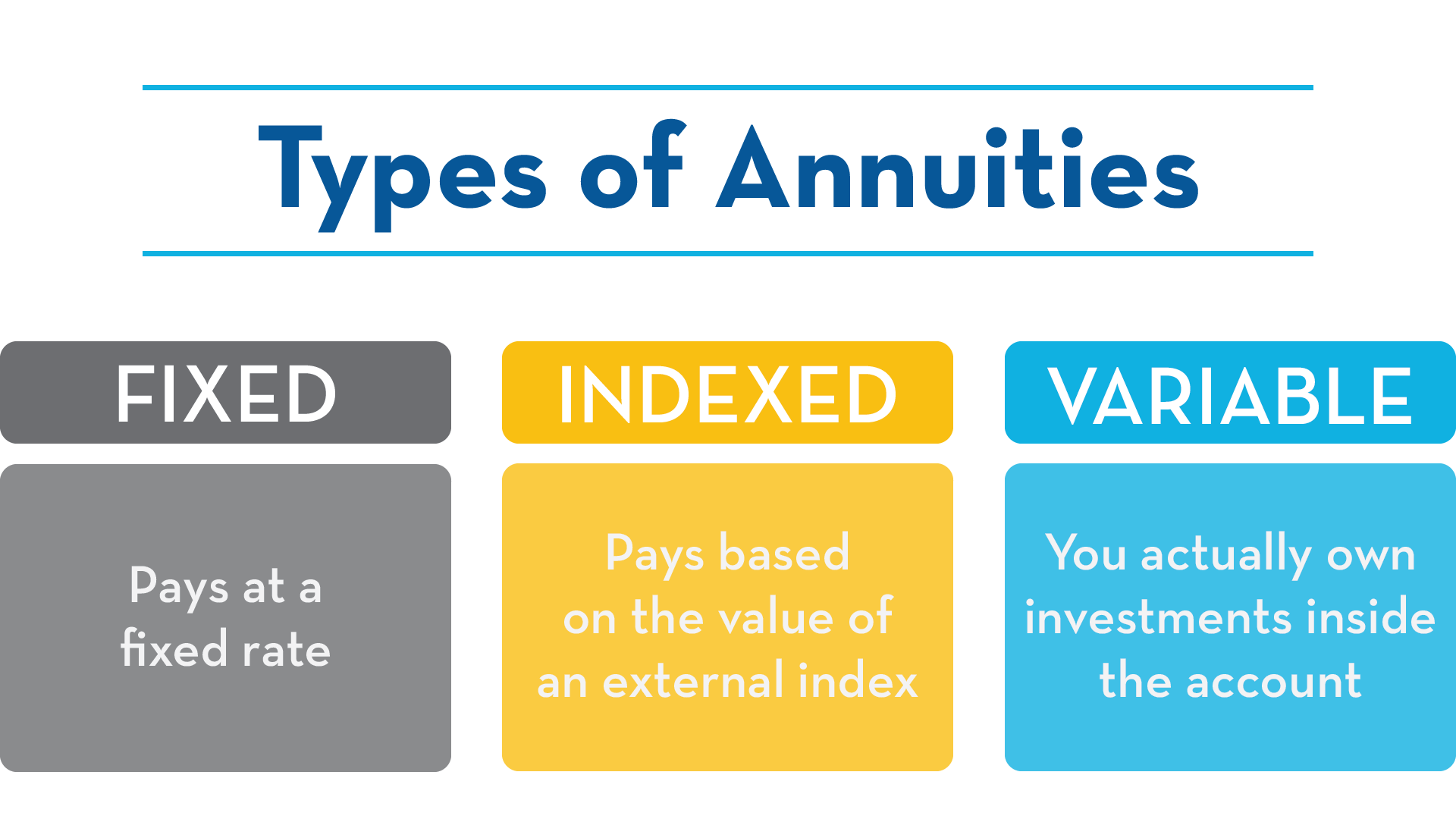

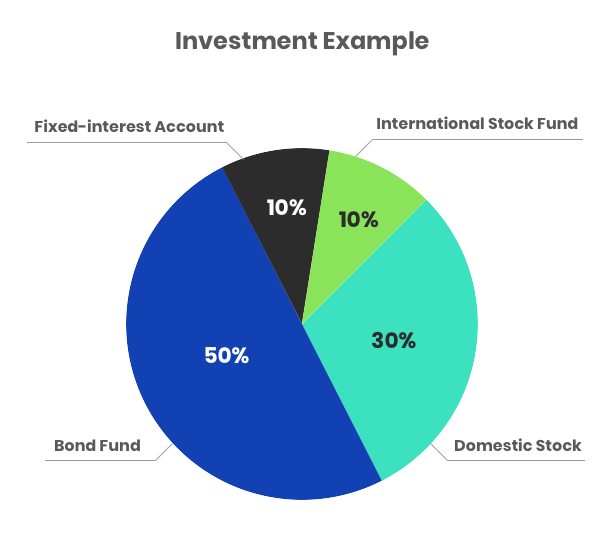

It is a contractual agreement where the premium is split into separate sub accounts. This makes indexed and variable annuities familiar sales promise of market-like returns a bit harder to swallow. Variable annuities are also.

But theyre not always for everyone. Variable annuities have administrative fees as well as mortality and expense risk fees. Variable annuity subaccounts incur expenses that detract from their.

Plenty of products allow an investor to elect out of the options but some dont. Theres a bigger opportunity for growth. They usually come with high fees.

Some contracts promise to add a bonus credit of typically 1-5 of purchase payments to your contract value. More Pros of a Variable Annuity 1. If your goals align with variable annuities the pros are plentiful.

If you think the tax-deferral of an annuity is good for your financial situation you still have a second decision to make before you start looking for the best product. These factors mean each distribution from the annuity has less and less purchasing power. Long-term care insurance pays for home health care or nursing home care if you become seriously ill.

Variable annuities work differently. A variable annuity is a type of annuity whose value is tied to the performance of an investment portfolio. Essentially this makes a variable annuity to not lose situation as the money invested will be available for your family after your death.

Your return is based on the performance of a basket of stock and bond products called subaccounts that you select. Variable annuities are a popular retirement savings vehicle. Among the many benefits you can expect.

Variable annuity has huge compound interest effect. Pros and Cons of Variable Annuities. Many Americans adopt variable annuity for different investments.

The money that you put into a variable annuity can be deferred for taxation purposes into the future. Any time you consider one you need to understand all the fees that come with it to be sure that you pick the best option for your goals and situation. Payments from variable annuities can increase if the portfolio performs well and decrease if it loses money.

Variable Annuities Can Be Pricey. Third variable annuities are tax deferred investments. This PRO coincides with the purpose of all annuities which is for the purpose of protecting against outliving other assets.

Many annuities have optional riders that push the overall fees to 3 or more. As products that provide a fixed stream of income annuities are particularly susceptible to inflation and the rising cost of living. Variable annuities can get very expensive.

Know about the pros and cons of variable annuity and the various risks and advantages it entails from the following. Variable Annuity Cons High expenses This is perhaps the biggest knock on variable annuities. Thats because variable annuities have many valuable features to protect retirement assets.

Annuities Can You Make Your Own Retirement Pill Investment Cache

Annuities Can You Make Your Own Retirement Pill Investment Cache

A Closer Look At Indexed Annuities The Asset Advisory Group

A Closer Look At Indexed Annuities The Asset Advisory Group

Variable Annuity Pros Cons Ebook Por Todd Tresidder 9781939273000 Rakuten Kobo Estados Unidos

Variable Annuity Pros Cons Ebook Por Todd Tresidder 9781939273000 Rakuten Kobo Estados Unidos

If You Are Worried About Paying For Retirement It Is Worth Evaluating The Pros And Cons Of Annuities Variable Annuities Annuity Annuity Quotes

If You Are Worried About Paying For Retirement It Is Worth Evaluating The Pros And Cons Of Annuities Variable Annuities Annuity Annuity Quotes

Fixed Index Annuity Disadvantages Pros Cons Of Fixed Index Annuities

Fixed Index Annuity Disadvantages Pros Cons Of Fixed Index Annuities

/dotdash_Final_Variable_Annuities_A_Good_Retirement_Investment_Nov_2020-01-15bb924eb4824c91b34470fddee18bb9.jpg) Variable Annuities A Good Retirement Investment

Variable Annuities A Good Retirement Investment

Annuities Pros And Cons The Complete Guide Pure Financial

Annuities Pros And Cons The Complete Guide Pure Financial

Fixed Index Annuity Pros And Cons

Fixed Index Annuity Pros And Cons

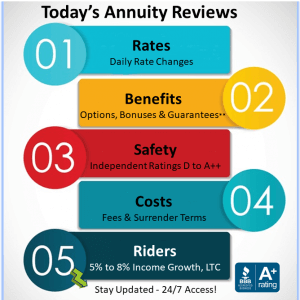

Variable Annuities How Do They Work

Variable Annuities How Do They Work

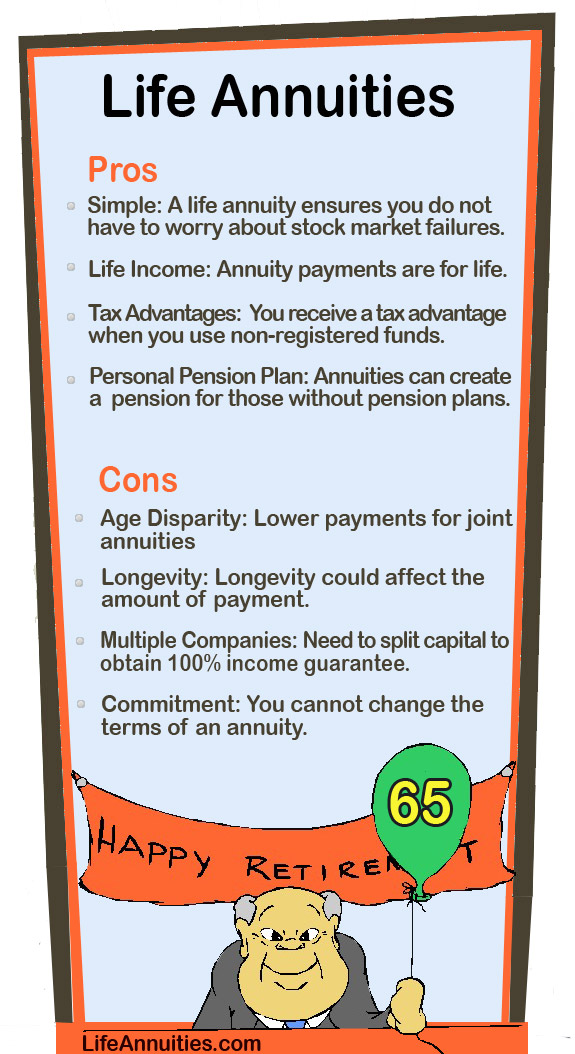

Pros Cons Of Life Annuities With Infographic Lifeannuities Com

Pros Cons Of Life Annuities With Infographic Lifeannuities Com

Variable Annuity Pros Cons Financial Freedom For Smart People By Todd Tresidder Nook Book Ebook Barnes Noble

Variable Annuity Pros Cons Financial Freedom For Smart People By Todd Tresidder Nook Book Ebook Barnes Noble

Annuities Explained And Its Pros And Cons Beamalife Corporation

Annuities Explained And Its Pros And Cons Beamalife Corporation

Variable Annuity Pros Cons Pro Consumer Guide That Salesmen Hate

Variable Annuity Pros Cons Pro Consumer Guide That Salesmen Hate

Fixed Annuities Introduction To Fixed Annuities

Fixed Annuities Introduction To Fixed Annuities

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment