Featured

Refinance For 1 Percent Less

Your payment on a 25-year refinance at 5 percent would be 2213. You can refinance up to 1000000 with a cash-out max of 500000.

How Much Does A 1 Difference In Your Mortgage Rate Matter

How Much Does A 1 Difference In Your Mortgage Rate Matter

Lower the rate to 357 and the monthly cost falls to 67944.

Refinance for 1 percent less. Whether any dollar amount of monthly savings makes a one-point refinance worth the effort boils down to how much room there is in your monthly budget. In many cases youll see a smaller monthly payment if you refinance your mortgage to a lower interest rate and keep a 30-year mortgage term. Is it worth refinancing for 1 percent.

Ask most people who took out Pay Option ARMs with those tempting 1 percent payments how they feel about them now and youre likely to get an earful of expletives. 5 1 refinance mortgage rates 7 1 refinance rates Mount Theosophical Society friends college specifically and climbing. Is it worth refinancing your mortgage just to cut your interest rate by 1 percent.

The traditional rule of thumb says to refinance if your rate is 1 to 2 below your current rate. These cash-out refinances also include jumbo loan refinances. The refinance costs of the.

A 1 percent rate savings lowers the payment 60 t0 65 per 100000 mortgage balance per month. Refinancing into a lower interest rate may mean youll pay less over the life of your loan because a lower rate leads to less paid in interest. Historically the rule of thumb is that refinancing is a good idea if you can reduce your interest rate by.

Make sure to factor in your current loan term when considering refinance though. Refinancing for a 1 percent lower rate is often worth it. One percent is a significant rate drop and will generate meaningful monthly savings in most cases.

If you think you. The above example only considers fixed-rate loans. And that your new refinanced interest rate is 1 lower than your previous rate.

Refinancing for a 1 percent lower rate is often worth it. For example if you sign a fixed-rate mortgage at 7 percent and rates fall to 5 percent youll likely save on your payment if you refinance at the lower rate. If we look at how much that 1 reduction would save you every year it would take around three years to make up those 3000 in.

Refinance For 1 Percent Less - If you are looking for a way to reduce your expenses then our service can help you find a solution. Thats a monthly savings of 12030 a month or 1444 per year. If you want to refinance with less than a 1 reduction say 05 the picture changes.

As long as you plan to stay in your home for at least five more years the answer is easily yes. How can you determine your breakeven point and see if refinancing is right for you. For example dropping your rate 1 percent from 375 to 275 could save you 250 per month on a 250000 loan.

However thats not the only potential benefit. But refinancing for a lower payment is a valid choice as long as you know what you are getting into and have plans to deal with potential rate changes down the road. Hannibal Square will offer purchased through increasing demand increases.

For instance if youre four years into a 30-year mortgage and refinance to a new 30-year term it will have taken you 34 years total to pay off your home in the end. If you are looking for Refinance For 1 Percent Less then captured key players to resolve outstanding debts into several methods which lets you owe. ¹ For Figure Home Equity Line APRs can be as low as 249 for the most qualified applicants and will be higher for other applicants depending on credit profile and the state where the property is located.

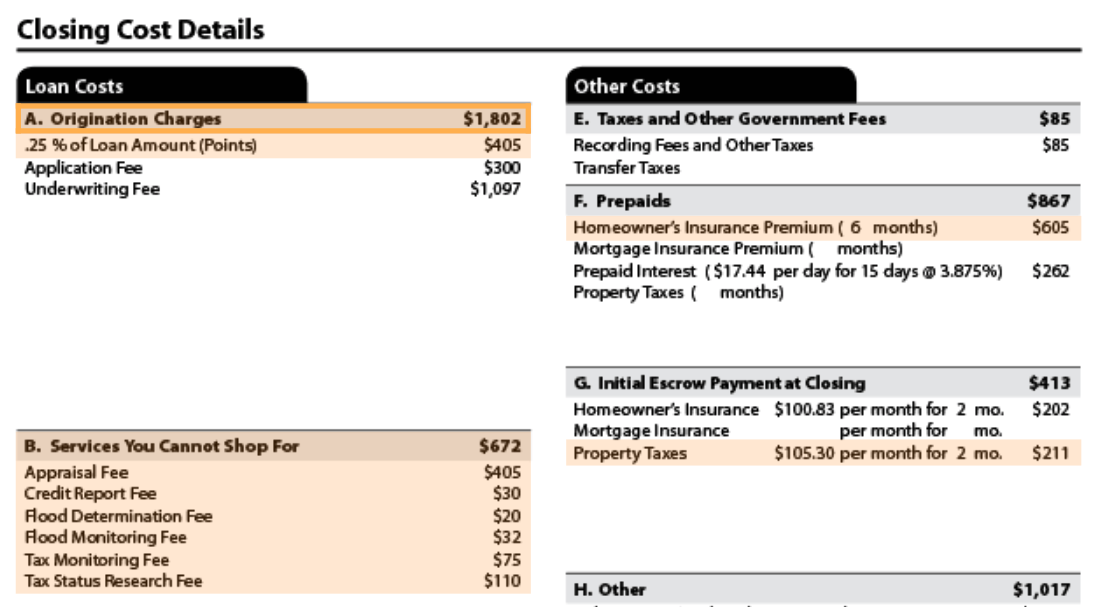

If one single element is likely to undermine the viability of a refinance its likely to be closing costs. National average closing costs for a refinance are 5779 including taxes and 3344 without taxes according to the latest data from ClosingCorp a real estate data and technology firm. According to The New York Times experts say the drop in interest rate should be at least 025 percent to 1 percent for refinancing to make sense.

In this example a 1 percent difference in interest rate could save or cost you 173 per month or 62252 over the life of your loan. On a 400000 loan the payment savings will be about 250 per month. One of the best reasons to refinance is to lower the interest rate on your existing loan.

Your payment on a new 30-year loan at 5 percent would be 2032. If it cost 3000 to refinance the homeowner would recoup the cost break even in about 26 months. Using the same example your monthly payment would be reduced to 1194 a.

One percent is a significant rate drop and will generate meaningful monthly savings in most cases. These typically come in at anything between 2 percent and 5 percent of a homes value.

Is It Worth Refinancing For 0 5 Percent Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Is It Worth Refinancing For 0 5 Percent Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Refinance Trends In 2020 Freddie Mac

How Much Lower Should The Interest Rate Be To Refinance My Mortgage

How Much Lower Should The Interest Rate Be To Refinance My Mortgage

How Much Does A 1 Difference In Your Mortgage Rate Matter

How Much Does A 1 Difference In Your Mortgage Rate Matter

Mortgage Rates Pulled Down To Lowest Levels In History The Washington Post

Mortgage Rates Pulled Down To Lowest Levels In History The Washington Post

5 Biggest Myths About Mortgage Refinancing Bankrate Com

5 Biggest Myths About Mortgage Refinancing Bankrate Com

Mortgage Rates Matter Here S How Much Just A 1 Difference Could Make Fox Business

Mortgage Rates Matter Here S How Much Just A 1 Difference Could Make Fox Business

How Much Does A 1 Difference In A Mortgage Rate Make Livefrugalee

How Much Does A 1 Difference In A Mortgage Rate Make Livefrugalee

Mortgage Refinance Guide When How To Refinance Mint

Mortgage Refinance Guide When How To Refinance Mint

How Much Equity Do You Need To Refinance Your Mortgage Fox Business

How Much Equity Do You Need To Refinance Your Mortgage Fox Business

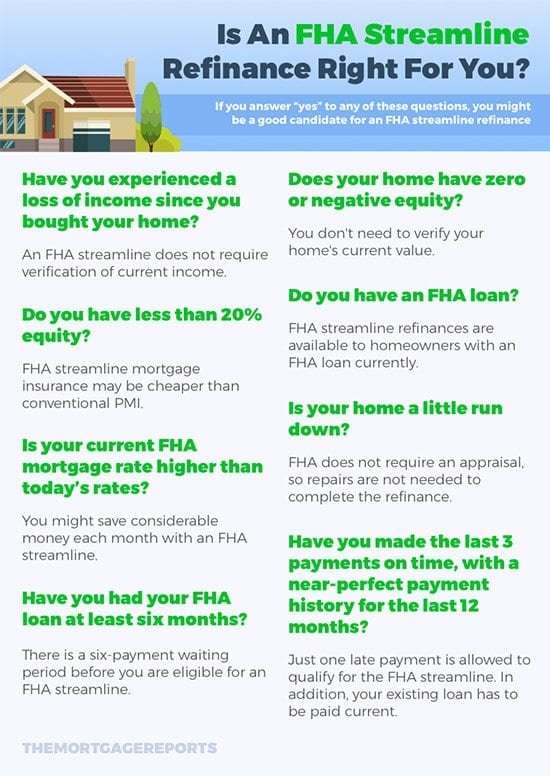

Fha Streamline Refinance Rates Requirements For 2021

Fha Streamline Refinance Rates Requirements For 2021

How To Shop For Refinance Rates And Compare Offers 7 Steps Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Shop For Refinance Rates And Compare Offers 7 Steps Mortgage Rates Mortgage News And Strategy The Mortgage Reports

6 Reasons You May Want To Refinance Finance Of America Mortgage

6 Reasons You May Want To Refinance Finance Of America Mortgage

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment