Featured

- Get link

- X

- Other Apps

Irs File My Tax Return

E-file for free using the IRS Free File service or by using online fillable forms. Finally youll need to submit everything by May 17 2021.

Irs Delays Tax Filing Deadline To May 17 Because Of Covid Related Changes Abc News

Irs Delays Tax Filing Deadline To May 17 Because Of Covid Related Changes Abc News

Your session will expire if you leave it idle for more than 20 minutes.

Irs file my tax return. You must print sign and mail prior year returns. It can take four weeks to be able to check your return status if you file a paper return. Yes you can file your 2020 tax return even if previous returns have not yet been processed.

File a Federal Income Tax Return. Are not self-employed but you still send a tax return for example because you receive income from renting out a property. If you do not file the IRS can file for you.

Typically the IRS sends out refunds in 21 days or less to taxpayers who have filed electronically. The IRS wants you to file a return voluntarily and on time every year. Individual Income Tax Return.

They may also just use statistics of income in your area to make a guess at your income. Businesses and Self-Employed Get your Employer ID Number EIN find Form 941 prepare to file make estimated payments and more. Be sure that you have all of this years tax forms.

You can file your Self Assessment tax return online if you. The IRS will likely only estimate your tax liability using old W-2 1099 forms. However if as a result of the excluded unemployment compensation you now qualify for deductions or credits not claimed on your original return you should file an amended return.

The IRS does not allow electronic filing for prior year returns through self-preparation websites. But if you dont file a return on time the IRS can eventually file a return for you its called a substitute for return or SFR. Log in to myTax Portal with your SingPass IRAS Unique Account IUA.

Viewing your IRS account information. Do not file a second tax return. The IRS is holding 29 million tax returns for manual processing meaning theyll require human review according to the National Taxpayer Advocate an independent arm of the tax agency that serves as a consumer watchdog.

However you can file an original return to replace the SFR. You cannot process a prior year return using IRS Free File. Click on Individuals File Income Tax Return to start.

Does not include Audit Representation. That backlog is delaying tax refunds for many Americans. The IRS uses the information it has usually information statements about your income like Forms W-2.

If this happens you most likely will not be getting the benefit of the doubt on anything. This return is called a substitute for return SFR. Expect delays if you mailed a paper return or had to respond to an IRS inquiry about your e-filed return.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. This electronic tax form may take you 5-10 minutes to complete. The IRS has tools for you to keep tabs on the status of your tax refund.

When you dont file a return the IRS sends a series of notices over a three-year stretch requesting that you file. To get your tax return started youll first need to find out how much money you made in 2020. You can file your tax return by mail through an e-filing website or software or by using the services of a tax preparer.

You should only call if it has been. Can I file the current years tax return if the IRS hasnt processed the previous years return yet. The return always ends in you owing the IRS taxes penalties and interest.

Refunds to start in May for guidance. When the IRS prepares a return on your behalf they will send. The IRS can legally file a tax return on your behalf which is called a Substitute for Return SFR.

Taxpayers with an AGI greater than the specified threshold can use the Free File Fillable Forms the e-file by purchasing commercial software or the Authorized IRS e-file Provider Locator Service. Please note you can only file your current year tax return using IRS Free File. This year some.

A limited number of companies provide software that can accommodate. This return will come under increased scrutiny by the IRS and go through a special filing. IRS Free File or e-file get your tax record and view your account.

Then youll need to decide whether to take the standard deduction or itemize your return. Prior year returns can only be filed electronically by registered tax preparers for the two previous tax years. 21 days or more since you e-filed Wheres My Refund tells you to contact the IRS.

By authorizing HR Block to e-file your tax return or by taking the completed return to file you are accepting the return and are obligated to pay all fees when due. Using the IRS Wheres My Refund tool. In order to determine where to file your return identify the form number for which you need the information and follow the numerical or alpha-numerical links below to.

Taxpayers with an AGI Adjusted Gross Income within a specified threshold can electronically file their tax return for free using Free File. By filing electronically however the IRS receives your tax return faster and you can check the status of your return and refund online sooner and if you e-file you can usually check your status within 24 hours. There is no need to call the IRS or file a Form 1040-X Amended US.

HR Block will explain the position taken by the IRS or other taxing authority and assist you in preparing an audit response. See IRS to recalculate taxes on unemployment benefits. Sarah TewCNET With Tax Day now on May 17 you have just a couple of weeks left to file your 2020 taxes.

If your confident you do then go ahead and file. Steps to File a Tax Return. The IRS began accepting and processing federal tax returns on February 12 2021.

/tax-documents-to-the-irs-3973948-v1-c43621daf8d548328ec95b4f53fd75ff.png) How To Mail Your Taxes To The Irs

How To Mail Your Taxes To The Irs

Irs E File Refund Cycle Chart For 2021 Where S My Refund

Irs E File Refund Cycle Chart For 2021 Where S My Refund

When Is Tax Day 2021 Where Can I File My Taxes Online How Do I File Taxes Online How Do I Sign Up For Turbotax H R Block Or Tax Slayer Can I

When Is Tax Day 2021 Where Can I File My Taxes Online How Do I File Taxes Online How Do I Sign Up For Turbotax H R Block Or Tax Slayer Can I

Filing Internal Revenue Service

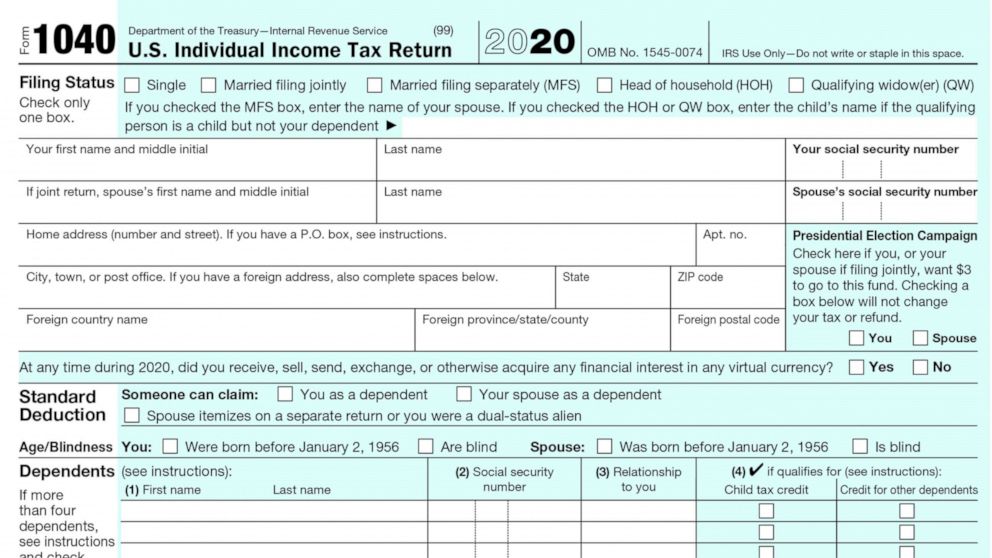

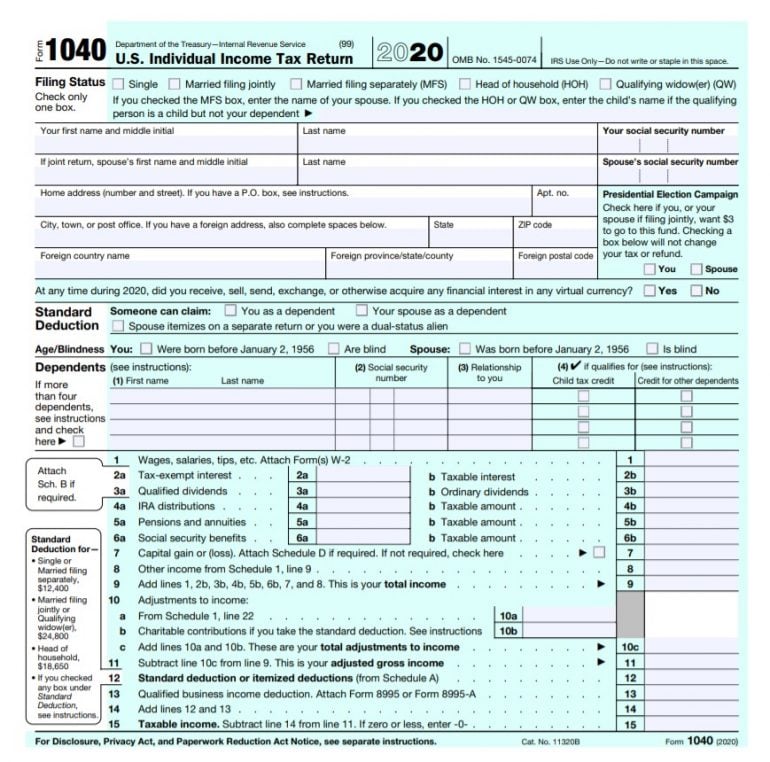

Irs Form 1040 Individual Income Tax Return 2021 Nerdwallet

Irs Form 1040 Individual Income Tax Return 2021 Nerdwallet

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

How To Check The Status Of Your Tax Return Get Transcripts Tfx User Guide

How To Check The Status Of Your Tax Return Get Transcripts Tfx User Guide

Why Did The Irs File My Taxes For Me

Why Did The Irs File My Taxes For Me

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension Cnet

How Early Can You File Your Taxes To Get Your Tax Refund

How Early Can You File Your Taxes To Get Your Tax Refund

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

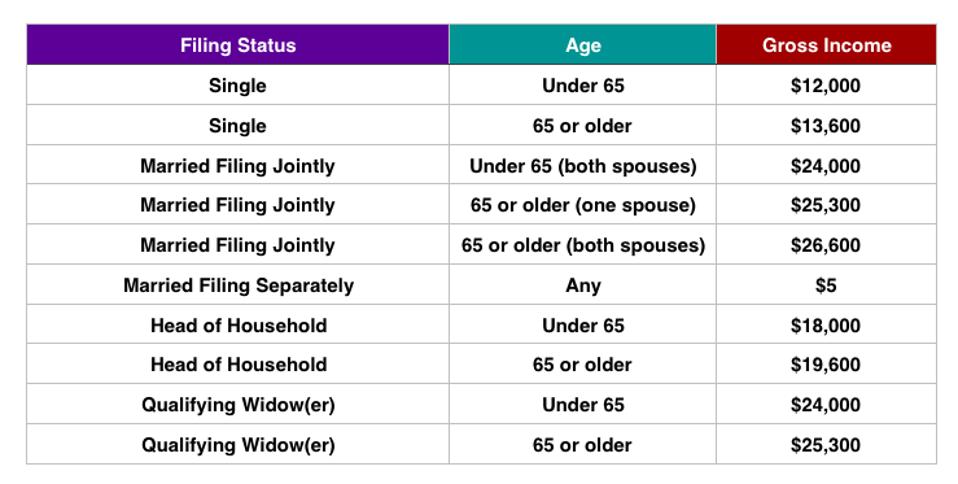

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

Irs Announces E File Open Day Be The First In Line For Your Tax Refund The Turbotax Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment