Featured

Can I Claim Stock Losses On My Taxes

However youre unable to convert any prior capital losses you have made as an investor into revenue losses. This can trigger CGT event K4.

June 4 2019 1042 PM Yes to claim losses for carry-forward treatment you will need to file tax returns for all previous years.

Can i claim stock losses on my taxes. Those losses that you reaped in the previous calendar year in your. This section provides information on capital losses and on different treatments of capital gains that may reduce your taxable income. Track the amount you paid for the purchase and sale of your stock also.

Bragging about stock market losses is never in style except when youre filing your tax returns. However you can minimize the damage by claiming the loss as a deduction on your income taxes. If you plan to sell a stock for a profit near the end of a calendar year.

If your activities change from investor to trader your investment changes from a CGT asset to trading stock. Writing off a stock market loss is a. If you deduct 3000 from your income but have more losses than that then you can still carry forward the rest of the losses to deduct from future years or to offset future gains.

Luckily Uncle Sam makes taking stock losses a little easier by giving investors the opportunity to write off losses at tax time. If your capital loss exceeds your capital gains for the year you may carry the loss back to one of the three previous years. These fees count toward the total loss when youre making your claim on the tax return.

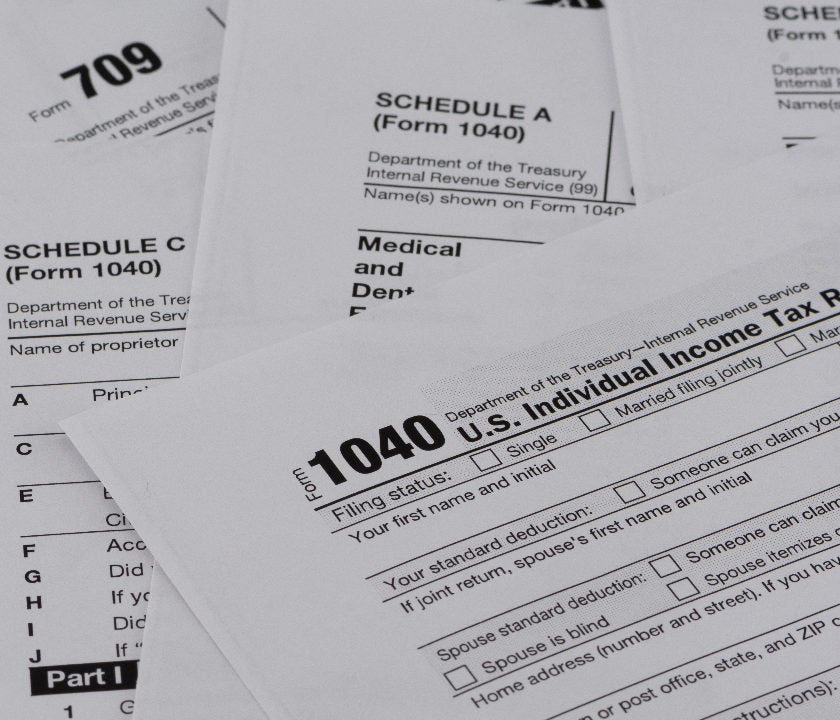

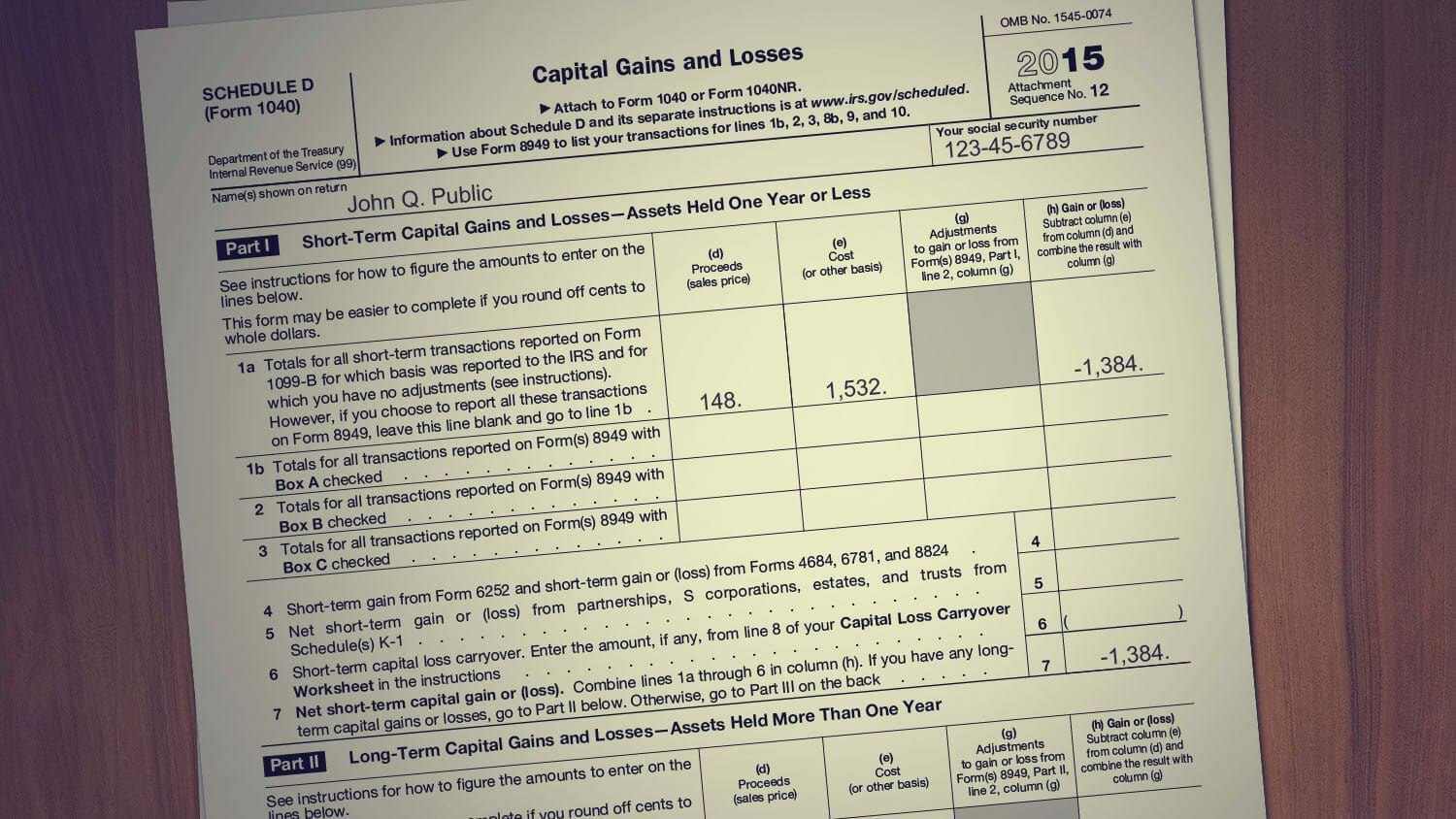

Re-classifying from investor to trader. Capital losses and deductions. If you can sell the stock or if it has become truly worthless your losses can offset either short-term or long-term capital gains on a dollar-for-dollar basis using IRS Schedule D and Form 8949.

Consult our Summary of loss application rules chart for the rules and annual deduction limit for each type of capital loss. However you must carefully document the stocks worthless status. You should continue to carry forward those capital losses.

Under the tax code investors can. You can also deduct up to 3000 of your losses from your income. The loss on each stock trade equals the amount you spent to buy.

Losing money on a stock youve invested in is never welcome news. Capital losses may be used to reduce capital gains in the year of sale any of the immediate three years or any future year. You can only claim stock market losses on your taxes when you actually sell the stock not just because the market price went down.

Generally you have to sell a stock to claim a capital loss so a bankrupt stock can cause problems. Minimizing Tax Using Capital Gains and Losses. If youve been a victim of the stock markets wild ride and sold stocks at a loss in 2020 dont.

The loss on stocks and any other capital asset is a capital loss. You can only deduct if. Since capital gains and losses come into play only when you dispose of capital property planning when to sell an item may be strategic.

Its never fun to lose money in the stock market except when you file your taxes. If we review your tax returns and find that you have incorrectly claimed losses you may be subject to penalties. You wont be able to claim the loss on your taxes until the stock is sold from your portfolio.

To claim capital losses complete Schedule 3 of your return and transfer the amount to line 12700 of your Income Tax and Benefit Return. Despite the additional calculations since capital losses apply directly to offset taxable capital gains the tax savings may be worth consideration. The losses will accumulate until until the loss is used up either by reducing your taxable income or netted against capital gains.

If your capital losses exceed your gains you can use up to 3000 of loss to offset your other income. The Internal Revenue Service recognizes this difficulty and allows you to deduct stock losses due to bankruptcy.

How To Get A Nice Tax Break On Your Stock Losses

How To Get A Nice Tax Break On Your Stock Losses

What Is Tax Loss Harvesting Morgan Stanley

What Is Tax Loss Harvesting Morgan Stanley

How To Claim Tax Deductions For Stock Losses Investor Junkie

How To Claim Tax Deductions For Stock Losses Investor Junkie

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/170042048-F-56a634653df78cf7728bd37a.jpg) How Will Selling My Stocks Affect My Taxes

How Will Selling My Stocks Affect My Taxes

Account For Losses In Tax Returns To Lower Tax Liability

Account For Losses In Tax Returns To Lower Tax Liability

Reap The Benefits Of Tax Loss Harvesting

Reap The Benefits Of Tax Loss Harvesting

Capital Gains Tax Rate Rules In Canada 2020 What You Need To Know

Capital Gains Tax Rate Rules In Canada 2020 What You Need To Know

Can I Claim A Loss On Stock Investments

Can I Claim A Loss On Stock Investments

Are There Limits To Stock Loss Deductions

How To Deduct Stock Losses From Your Taxes Bankrate

How To Deduct Stock Losses From Your Taxes Bankrate

/taxescoins-5bfc325146e0fb00514616ad.jpg) How To Deduct Stock Losses From Your Tax Bill

How To Deduct Stock Losses From Your Tax Bill

What Is The Capital Loss Deduction The Motley Fool

What Is The Capital Loss Deduction The Motley Fool

/SchedD-59e44eca73a940459e36066f830ebf63.jpg) Schedule D Capital Gains And Losses Definition

Schedule D Capital Gains And Losses Definition

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment