Featured

Etf And Dividends

These high-dividend stocks tend. Vanguard Dividend Appreciation ETF VIG Sometimes the simplest strategies are the best.

One Dividend Etf To Own Now 4 To Avoid

One Dividend Etf To Own Now 4 To Avoid

To receive a qualified dividend you must hold an ETF for more than 60 days before the dividend is issued.

Etf and dividends. An automatic dividend reinvestment plan DRIP is simply a program offered by a mutual fund ETF or brokerage firm that allows investors to have their dividends automatically used to purchase. Best Stocks ETFs and Mutual Funds by Industry The JP Morgan Income ETF generates income buy selling options and investing in high. 793 The hungriest of dividend investors or those looking for high-yield ETFs should know about Global X SuperDividend ETF.

If youre looking for dividend income that will increase over time check out the SPDR SP Dividend ETF NYSEMKTSDYThe funds benchmark is the SP High Yield Dividend. All three are paying dividends that yield more than 6. VIG is considered by many to be the elite dividend growth ETF.

You can see a dividend ETFs annual payout on its prospectus or its website. Like much in the world of ETFs dividend ETFs offer a simple and straightforward solution to getting exposure to a specific investing niche in this case stocks that pay a regular dividend. Dividend exchange-traded funds ETFs are designed to invest in a basket of high-dividend-paying stocks.

VIG is pretty straightforward. These dividends are paid on stock held by the ETF which must own them for more than 60 days during the 121-day period that begins 60 days before the ex-dividen. Exchange listed securities of companies that pay above-average dividends and have.

The current tax rates on qualified dividends. To calculate the dividend yield yourself divide the most recent dividend payment by. It targets stocks which have raised their dividend for at least 10.

An ETF pays out qualified dividends. These exchange-traded funds offer yields of 5 or more for income investors. Dividend ETFs at least in some allocation belong in just about every portfolio.

There are 2 basic types of dividends issued to investors of ETFs. These are dividends designated by the ETF as qualified which means they qualify to be taxed at the capital gains rate which depends on the investors modified adjusted gross income MAGI and taxable income rate 0 15 or 20. Dividend Achievers Select Index a benchmark which.

It tracks the NASDAQ US. It may seem a bit counterintuitive in the current environment given. SPDR SP Dividend ETF.

Although exchange-traded funds ETFs are primarily associated with index-tracking and growth investing there are many that offer income by owning. KBWD is a dividend-focused ETF that zeroes in on the financial sector. This ETF tracks the Value Line Dividend Index which is a modified equal-dollar weighted index comprised of US.

An ETF must pay out the dividends to investors and can make them either by distributing cash or by offering a reinvestment in additional shares of the ETF. 059 or 59 for every 10000 invested SEC Yield.

No Dividend Strategy Etfs Are Dividend Champions But There Is One Contender Seeking Alpha

No Dividend Strategy Etfs Are Dividend Champions But There Is One Contender Seeking Alpha

How To Find And Compare Dividend Etfs Ycharts

How To Find And Compare Dividend Etfs Ycharts

Dividend Focused Etfs That Outperformed During The Bull Market Financial Planning

Dividend Focused Etfs That Outperformed During The Bull Market Financial Planning

The Best Dividend Etf In The Accumulation Phase Dividend Growth Investor

The Best Dividend Etf In The Accumulation Phase Dividend Growth Investor

Which Vanguard Dividend Etf Is Winning The Race In 2018 The Motley Fool

Which Vanguard Dividend Etf Is Winning The Race In 2018 The Motley Fool

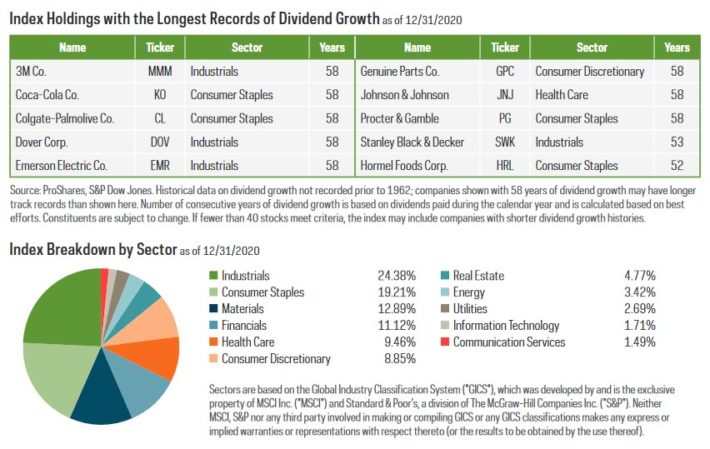

The Dividend Aristocrats Etf Own The 53 Best Dividend Growers Cabot Wealth Network

The Dividend Aristocrats Etf Own The 53 Best Dividend Growers Cabot Wealth Network

The Best Dividend Aristocrats Etfs Dividendinvestor Com

The Best Dividend Aristocrats Etfs Dividendinvestor Com

The Impressive Dividend History Of Vanguard Dividend Appreciation Etf The Motley Fool

The Impressive Dividend History Of Vanguard Dividend Appreciation Etf The Motley Fool

Low Volatility And High Dividend Funds One Of These May Be In A Bubble Investor S Business Daily

Low Volatility And High Dividend Funds One Of These May Be In A Bubble Investor S Business Daily

A Caution From 2007 Beware Of The Dividend In Your High Dividend Etfs Funds Etf Trends

A Caution From 2007 Beware Of The Dividend In Your High Dividend Etfs Funds Etf Trends

The 2021 List Of Dividend Exchange Traded Funds

The 2021 List Of Dividend Exchange Traded Funds

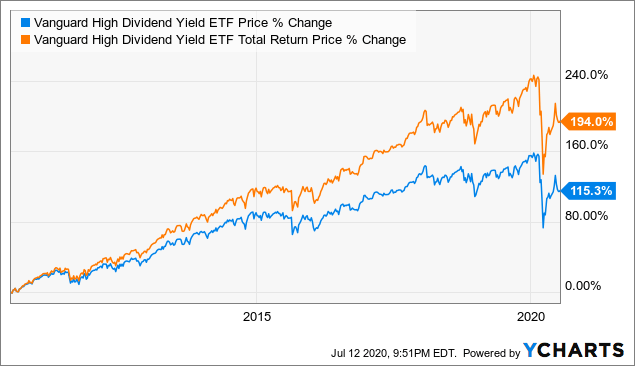

Vanguard High Dividend Yield Etf Should Benefit From The Current Low Rate Environment Nysearca Vym Seeking Alpha

Vanguard High Dividend Yield Etf Should Benefit From The Current Low Rate Environment Nysearca Vym Seeking Alpha

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

:max_bytes(150000):strip_icc()/dividends-5bfc2e7f46e0fb00511a3b38.jpg)

Comments

Post a Comment