Featured

Refinance 15 Year Mortgage To 30 Year

Refinancing to a 15-year mortgage may get you to the finish line faster but its important to know how it works and the financial. 30-year payment 955 with total interest paid of 143739 15-year payment 1430 with total interest paid of 57357.

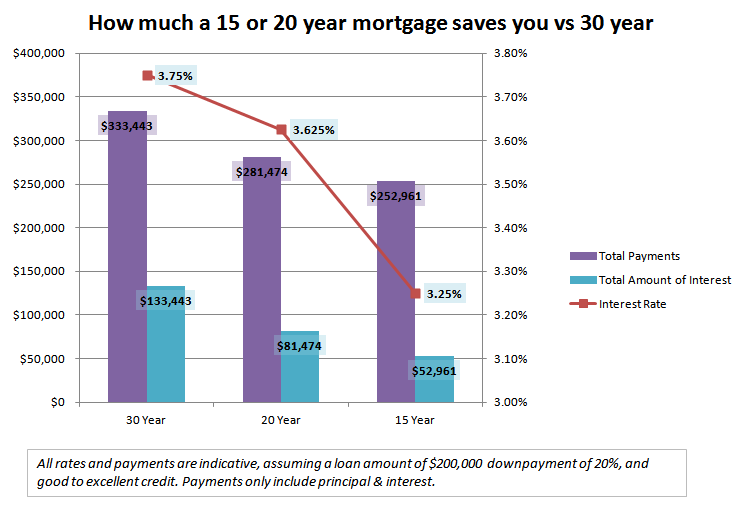

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

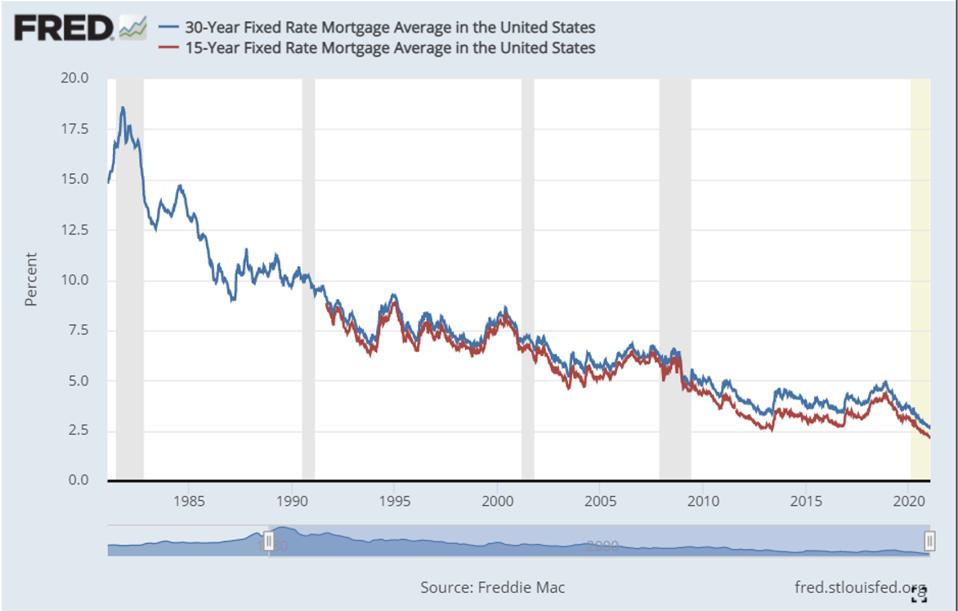

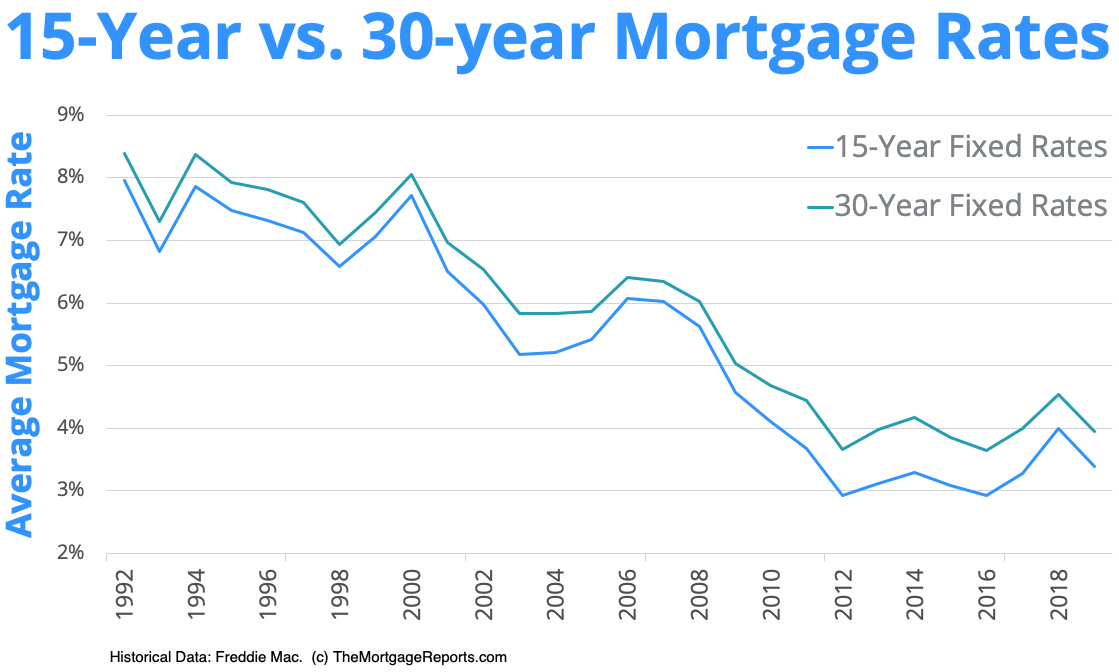

Fifteen-year fixed-rate mortgages come with even lower rates than 30-year loans.

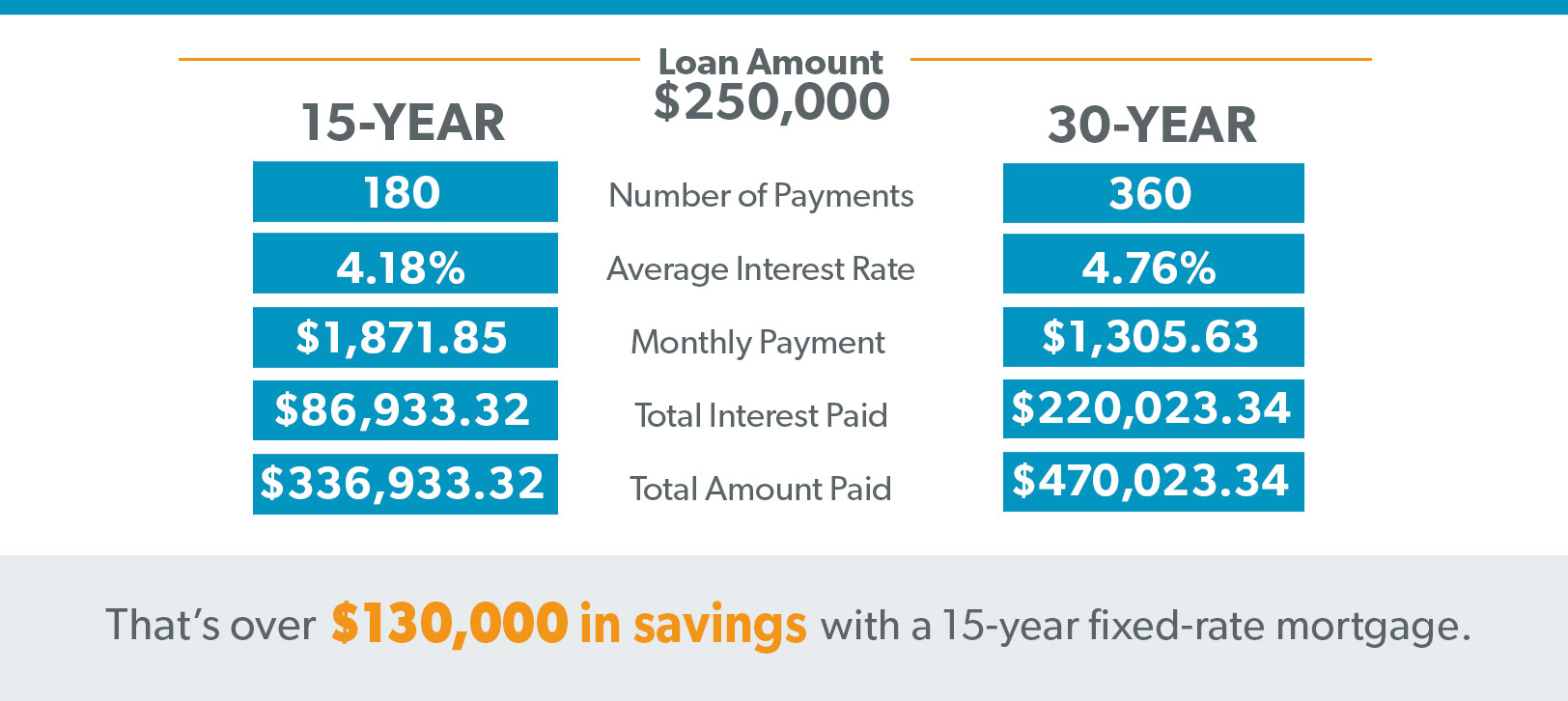

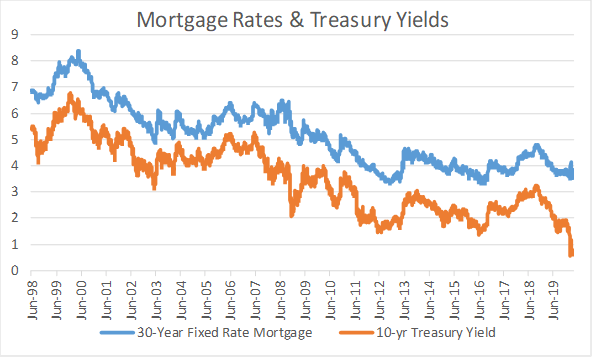

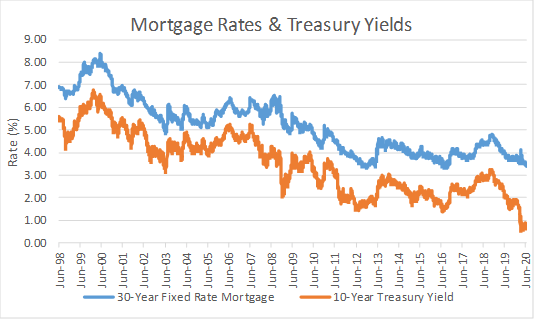

Refinance 15 year mortgage to 30 year. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year. Lets say you have a 250000 30-year mortgage at a 4 APR. Refinancing into a 15-year mortgage helps you build equity faster but it may increase your monthly payment as the table below shows.

Remaining loan balance on the 15-year loan after seven years. The 30-year mortgage in the same amount at 313 interest would have much higher lifetime interest costs. If youre looking to pay off your home sooner refinancing can even allow you to change your loan term from 30 years to 15.

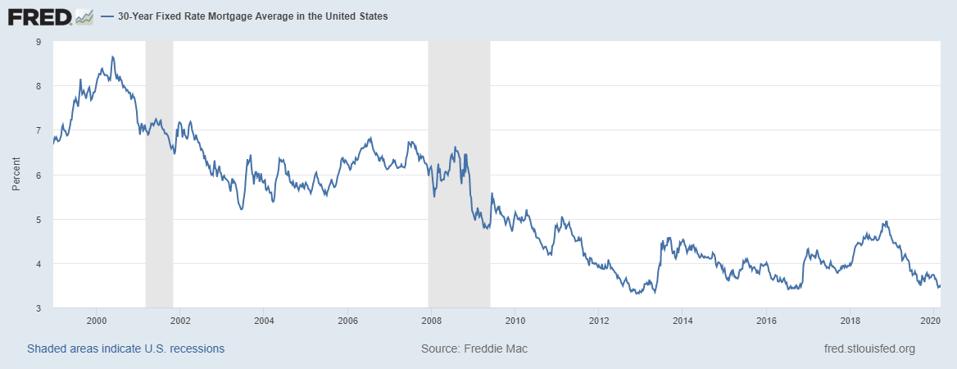

However according to Freddie Mac the weekly average rate as of May 28 for fixed-rate loans was 315 percent for a 30-year mortgage and 262. Monthly Principal and Interest on 30-Year vs. Currently an average 258 down from 325 a year ago and 404 at.

Refinancing from a 30-year to a 15-year mortgage allows you to build equity faster and pay less interest but the payment must fit into your budget. For example if you currently have 15 years left on your mortgage refinancing to a 30-year loan would allow you to make the repayments over a period twice as long. This in combination with the shorter term will help you save a great deal on interest charges.

Refinancing from a 30-year fixed-rate mortgage into a 15-year fixed loan can result in paying down your loan sooner and saving lots of dollars otherwise spent on interest. Many borrowers opt for 30-year refinance loans for the same reason they secured a 30-year mortgage. Refinancing from a 30-year fixed-rate mortgage into a 15-year fixed loan can help you pay down your mortgage faster and save a lot of money on interest especially if rates have fallen since you bought.

There are several different options including 15-year 20-year and 30-year refinance loans. With the 15-year loan you will pay only 56122 in total interest costs. For example lets look at a 200000 at 4 on a 30-year loan and the same loan at 35 on a 15-year term.

Youll own your home. With mortgage rates hitting record lows it can be tempting to consider a 15-year-mortgage instead of one spanning 30 years. Build home equity much faster.

119674 Youll pay less interest with a 15-year loan. Refinance 30 Year Mortgage To 15 Apr 2021. If you currently have a 30-year mortgage and have room in your budget for a higher monthly mortgage payment refinancing to a 15-year fixed-rate loan can make good financial sense.

The interest rates for 15-year loans are lower currently 2. With the 30-year loan youll pay 147903 in interest costs over the life of your loan. Historically American homeowners typically move homes or refinance about every 5 to 7 years.

After the Great Recession this window moved out to about 10 years. With the 15-year mortgage in the earlier example in the amount of 250000 and at 259 interest the interest costs would be about 52000 over the life of the loan. Cash-Out Refinance Your lender might allow you to refinance for more than you owe if youve paid.

Even if you can significantly reduce your interest rate with a 15-year note your monthly payment will likely go up. 15-Year Refi 30.

Mortgage Rates Are Probably Going Up So Get A 30 Year

Mortgage Rates Are Probably Going Up So Get A 30 Year

15 Vs 30 Year Mortgage In An Infographic

15 Vs 30 Year Mortgage In An Infographic

15 Year Refinance Mortgage A Smart Move In 2019

15 Year Refinance Mortgage A Smart Move In 2019

30 Year Mortgage Rates Chart Historical And Current Rates

30 Year Mortgage Rates Chart Historical And Current Rates

With Mortgage Rates So Low Is Now A Good Time To Refinance

With Mortgage Rates So Low Is Now A Good Time To Refinance

Should You Refinance Into A 30 Year Or 15 Year Mortgage During Coronavirus Fox Business

Should You Refinance Into A 30 Year Or 15 Year Mortgage During Coronavirus Fox Business

Historical Mortgage Rates 30 And 15 Year Chart

Historical Mortgage Rates 30 And 15 Year Chart

15 Year Fixed Vs 30 Year Fixed The Pros And Cons The Truth About Mortgage

15 Year Fixed Vs 30 Year Fixed The Pros And Cons The Truth About Mortgage

Should You Take Out A 30 Year 20 Year Or A 15 Year Mortgage

Should You Take Out A 30 Year 20 Year Or A 15 Year Mortgage

Why You Should Wait To Refinance Seeking Alpha

Why You Should Wait To Refinance Seeking Alpha

The Mortgage Refinance Question Nasdaq Mbb Seeking Alpha

The Mortgage Refinance Question Nasdaq Mbb Seeking Alpha

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

15 Year Mortgage Rate Charts Mortgage Rates Mortgage News And Strategy The Mortgage Reports

15 Year Mortgage Rate Charts Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment