Featured

April 15 Tax

However this relief does not apply to estimated tax payments that are due on April 15 2021. First off the basics.

15 Tax Filing Tips For April 15 Don T Mess With Taxes

2017 Tax Return IRS Refund deadline.

April 15 tax. This postponement applies to individual taxpayers including individuals who pay self-employment tax. An extension filing delays the tax-filing deadline for six-months. Those who make estimated tax payments are still on the hook for their first quarterly levy which is due on the original tax filing deadline of April 15.

But the extension does not apply to estimated tax payments that are due on April 15 the IRS said in a statement. Also from Fortune magazine an explanation of why April 15 was chosen. 2019 Return refund is April 15 2023.

MANILA Philippines The April 15 deadline to file and pay income tax returns ITRs stays giving limited time to corporate taxpayers which may scramble to adjust their 2020 payments to the lower rates provided as a relief amid the pandemic-induced recession under the newly signed Corporate Recovery and Tax Incentives for Enterprises CREATE Law. IR-2021-78 April 8 2021. WASHINGTON The Internal Revenue Service today reminded self-employed individuals retirees investors businesses corporations and others who pay their taxes quarterly that the payment for the first quarter of 2021 is due Thursday April 15 2021.

When the 16th Amendment which allows Congress to institute the income tax was adopted on Feb. Tax deadline to May 17 The IRS is postponing the tax filing deadline to May 17 from April 15 the agency said Wednesday. We focus on helping potential clients understand how they can grow their business by having access to their data 247.

If you have not filed your 2017 IRS Tax Return and expect a tax refund you have until 04152021 to submit the return on paper and to claim your refund. This means that all individual and C-corporation tax returns normally due on April 15 can be filed and paid by July 15 without submitting any extensions and theyll avoid any late filing or late payment penalties. The IRS noted that individual taxpayers can postpone federal income tax payments for the 2020 tax year due on April 15 to May 17 without penalties and interest regardless of the amount owed.

The date is usually on or around April 15. But normal and typical doesnt seem to apply to anything these days and this years tax season is no exception. Government will postpone the April 15 tax-payment deadline for millions of individuals giving Americans an additional 90 days to pay their 2019 income-tax bills in an.

April 15 isnt most Americans favorite day and thats because most years its the official federal tax deadline. Under current law individual taxpayers must file 2019 income tax returns or an automatic extension form 4868 by April 15 2020. April 15 2015 600 AM EDT F ounding Father Benjamin Franklin famously said that the only things certain in this world were death and taxes but he wasnt necessarily talking about federal income.

Tax Day in the United States Many United States residents mark Tax Day as the deadline to file their income tax details to the Internal Revenue Service IRS. That will give taxpayers more time to file tax returns and settle bills. 2017 Tax Forms tools.

However this deadline may be extended to accommodate holidays or extreme weather conditions. The April 15 tax deadline has been extended to May 17 2021 for individual tax payers. These payments go toward estimated taxes on.

The IRS pushed the federal income tax deadline back to May 17 from its usual April 15 following an outcry from legislators and industry leaders who said taxpayers are still facing health and economic issues related to the pandemic. That includes people who have income that. 3 1913 Congress chose March 1one year and a few dozen days lateras the deadline for filing returns.

Individual taxpayers can also postpone federal income tax payments for the 2020 tax year due on April 15 2021 to May 17 2021 without penalties and interest regardless of the amount owed. Tax Day as its called has a long and interesting history in the States that. The 2018 Return refund deadline is April 15 2022.

Tax day according to the IRS and the Treasury Department has been pushed back from the normal deadline for the federal income tax filing date from April 15 to. IRS reminds taxpayers to make April 15 estimated tax payment. Here at April 15 Taxes Inc our expertise is finding complete Income Tax and Cloud Accounting solutions for individuals and businesses.

April 15 is typically the last day to file your income taxes and pay taxes owed. IRS postpones April 15 US. For the first time in history the IRS has moved the April 15 tax deadline to July 15.

National Tax Day April 15 National Day Calendar

National Tax Day April 15 National Day Calendar

April 15th Tax Deadline And Filing An Extension Mcruer Associates

April 15th Tax Deadline And Filing An Extension Mcruer Associates

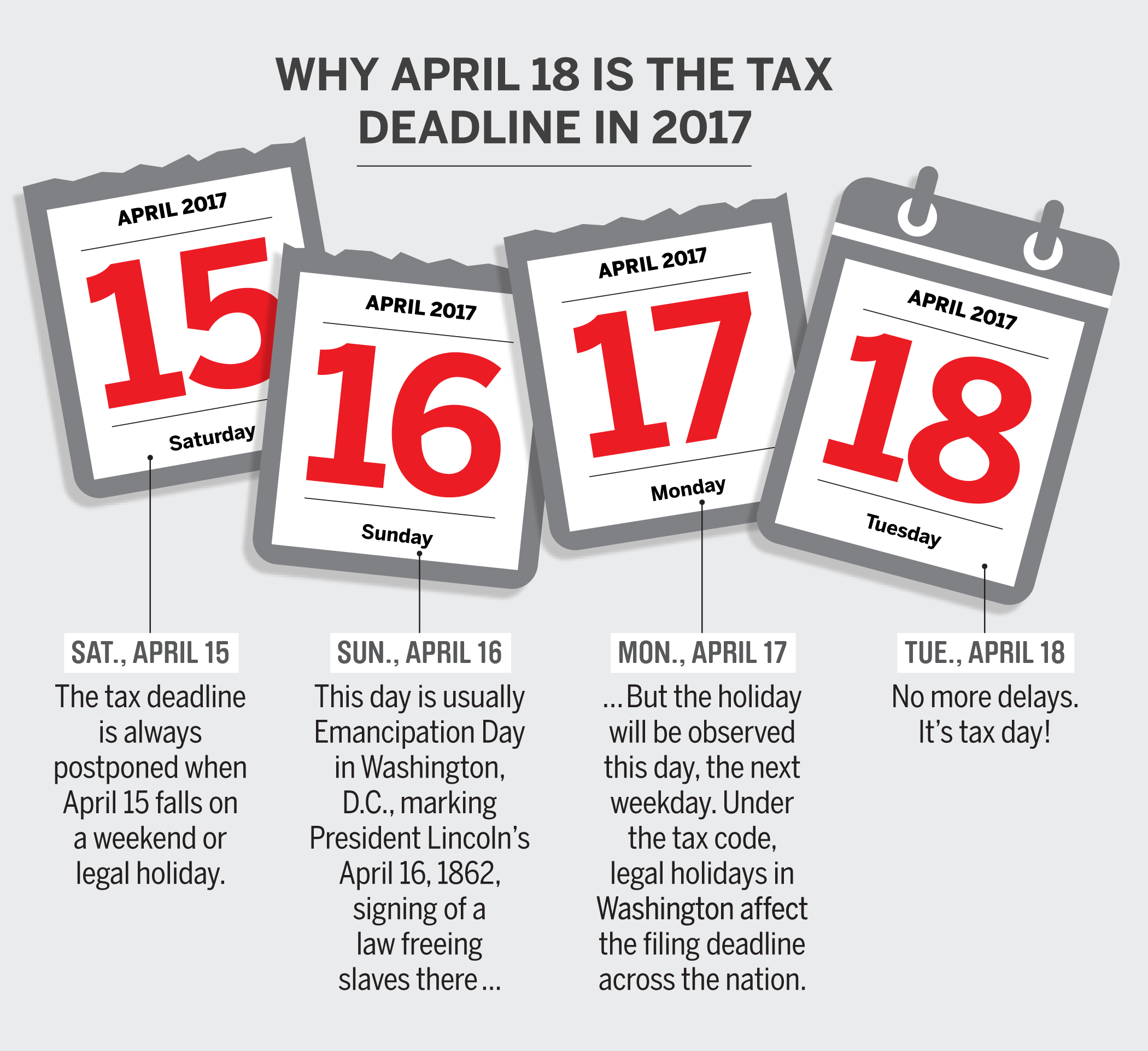

When Are Taxes Due In 2017 Not April 15 Money

When Are Taxes Due In 2017 Not April 15 Money

Tax Day April 15 Calendar And Clock Vector Design 1870606 Vector Art At Vecteezy

Tax Day April 15 Calendar And Clock Vector Design 1870606 Vector Art At Vecteezy

What If You Can T File Your Income Taxes By April 15 The Irs Gives Extensions To Anyone Cpa Practice Advisor

What If You Can T File Your Income Taxes By April 15 The Irs Gives Extensions To Anyone Cpa Practice Advisor

Is April 15 Tax Day This Year Are Taxes Due Today Money

Is April 15 Tax Day This Year Are Taxes Due Today Money

April 15 Tax Day Things You Don T Want To Hear From Your Accountant Tax Day Tax Deadline National Tax Day

April 15 Tax Day Things You Don T Want To Hear From Your Accountant Tax Day Tax Deadline National Tax Day

Tax Day Concerns Properly Filing Your Business Tax Returns Priori

Tax Day Concerns Properly Filing Your Business Tax Returns Priori

Tax Day 2019 Is April 15 And April 17 Don T Mess With Taxes

April 15 Tax Deadline National Tax Training School

April 15 Tax Deadline National Tax Training School

April 15 Tax Deadline Extended The Southeast Examiner Of Portland Oregon

April 15 Tax Deadline Extended The Southeast Examiner Of Portland Oregon

April 15 Tax Deadline On Calendar Time To File Taxes A Flickr

April 15 Tax Deadline On Calendar Time To File Taxes A Flickr

Tax Day 2015 What To Do If You Can T Meet Today S Deadline Abc News

Tax Day 2015 What To Do If You Can T Meet Today S Deadline Abc News

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment