Featured

Student Loan Transfer

However the longer repayment period may result in the total repayment amount being more. A consolidated loan usually has a lower interest rate and a much longer repayment period which can reduce monthly payments so that the debt is more manageable.

What Happens To Transferred Student Loans Credit Karma

What Happens To Transferred Student Loans Credit Karma

How to do a balance transfer of student loans to a zero-interest credit card 1.

Student loan transfer. However if things go poorly borrowers may miss payments or fall for a scam. Even when youre married you and your spouse have separate credit scores. The new interest rate may be much higher than on the Parent.

Balance Transfer Student Loans Using Bank of America Optimal Method. When you consolidate your Federal student loans you get to pick your loan provider. Before giving you an.

A series of steady payments on a loan can help repair bad credit. Apply for Public Service Loan Forgiveness. This means you would need to start paying back your loans only after you either drop below half time or graduate.

Before requesting a balance transfer make sure to gather. This private lender could be a bank credit union or an online institution like SoFi or CommonBond. Another path away from.

The borrower isnt required to repay the loan as soon as heshe avails an education loan. But federal loans for students have lower interest rates. Student loans dont transfer between schools so no matter when you switch colleges youll need to resubmit your FAFSA form.

Betsy Mayotte president and founder of The Institute of Student Loan Advisors TISLA says that the most important thing borrowers should know is that student loan transfers between servicers and lenders happen all the time and typically dont come with. Student loans offer not just financial ease but also tax benefits. If one spouse needs to repair their credit score it might make sense to transfer a student loan to their.

Phone Call You need to call the phone number on the back of your credit card and speak to a live representative. When you refinance your student loans you combine all your federal and private loans into one new loan with a private lender. Multiple student loans are often consolidated into a single loan by transferring the unpaid amounts into one new loan.

The 0 period on a balance transfer card doesnt last forever. Another option is for the student to obtain a private loan in their own name and use it to pay off the Parent PLUS loan. Transfer the Debt to the Student by Refinancing It.

I know some of you dont like calling on the phone but a 10-minute phone call can save you thousands of dollars so its worth it. Deferment of repayment is the most significant advantage of education loans. Note the student will be starting with a brand new loan.

Most federal and private student loans allow you to defer repayments while youre still a full-time student. Gather all of the necessary information. Rather you can access the FAFSA already on file and resubmit it.

Transferring schools can affect your student loans and overall financial aid package whether you are planning to transfer at the end of the fall semester or at the end. While borrowers have several different ways to transfer their student loan debt the process is the same once you choose an option. How You Can Transfer Student Loans to Another Lender Consolidate Loans.

If you are transferring mid-year you do not need to complete a new form from scratch. Before you can start the process you need a credit card with zero interest. These loans can be deferred to a time until the applicant starts earning within a stipulated timeframe.

When you want to repair a spouses credit. A common headache of life with student loans is dealing with a loan servicer transfer or change. For most borrowers the best-case scenario is a minor inconvenience.

Transferring student loans to parents Some private lenders will let you transfer a student loan to a parent by refinancing it in their name. You typically get 15 to 18 months at 0 before the rate soars to the ongoing APR which might be 15 20 or more. Typically your student loans go into repayment when you transfer schools though it depends on what type of loan you have.

Transfer Tuesday STUDENT LOAN SAVINGS M1 Invest - YouTube. I wont be able to make as much progress on my student loan savings this month but every little bit countsWhat did you do for Transfer Tuesd. Transferring a student loan to the spouse with the better credit score may land you a lower interest rate.

Get the right zero-interest credit card. New terms conditions and interest rates will apply. This could include a private student loan or a non-education loan.

If you dont have.

Student Loan Forgiveness The Guide To 80 Programs

Student Loan Forgiveness The Guide To 80 Programs

How Transferring Colleges Can Affect Student Loans Student Loan Ranger Us News

How Transferring Colleges Can Affect Student Loans Student Loan Ranger Us News

So Your Loan Was Transferred What S Next Fsa

So Your Loan Was Transferred What S Next Fsa

Can A Parent Loan Be Transferred To The Student Nerdwallet

Can A Parent Loan Be Transferred To The Student Nerdwallet

What Happens When Your Student Loan Servicer Gets Bought Bankrate

What Happens When Your Student Loan Servicer Gets Bought Bankrate

Transferring Schools 6 Things To Know About Your Student Loans Fox Business

Transferring Schools 6 Things To Know About Your Student Loans Fox Business

How To Refinance Student Loans With A 0 Credit Card Balance Transfer Student Loan Hero

How To Refinance Student Loans With A 0 Credit Card Balance Transfer Student Loan Hero

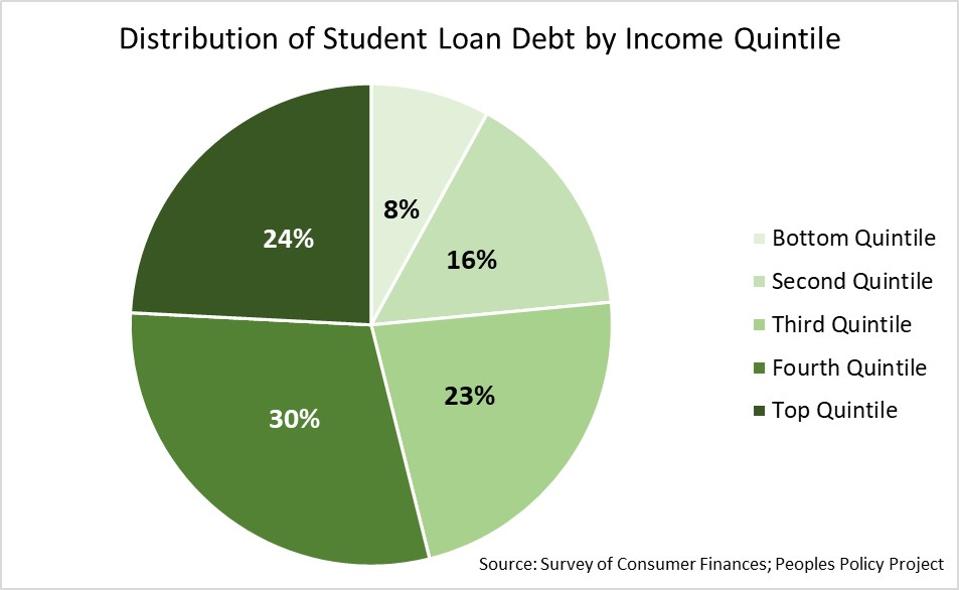

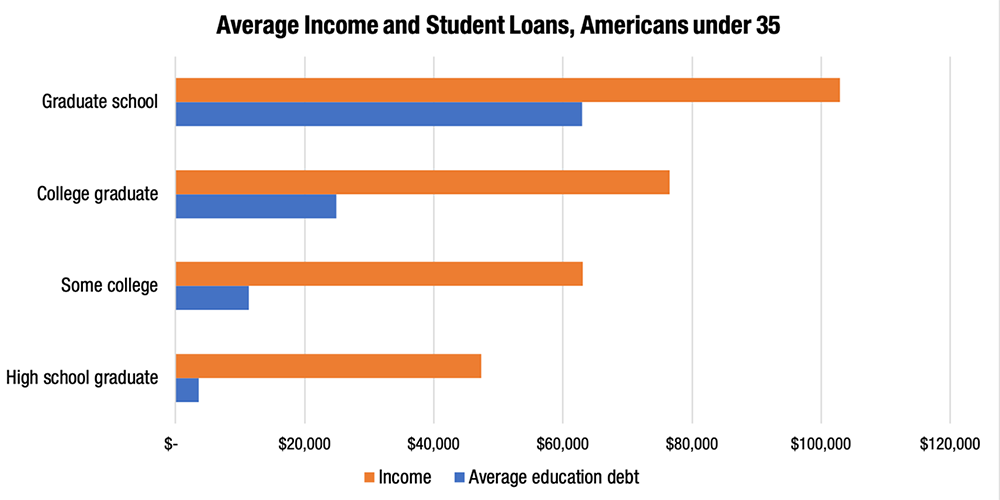

The Case Against Student Loan Forgiveness

The Case Against Student Loan Forgiveness

Chart U S Student Debt Is A National Problem Statista

Chart U S Student Debt Is A National Problem Statista

The False Promise Of Student Loan Forgiveness Economics21

The False Promise Of Student Loan Forgiveness Economics21

Why Did My Student Loan Get Transferred

Why Did My Student Loan Get Transferred

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment