Featured

How Much Money Do You Get For Taxes Per Child

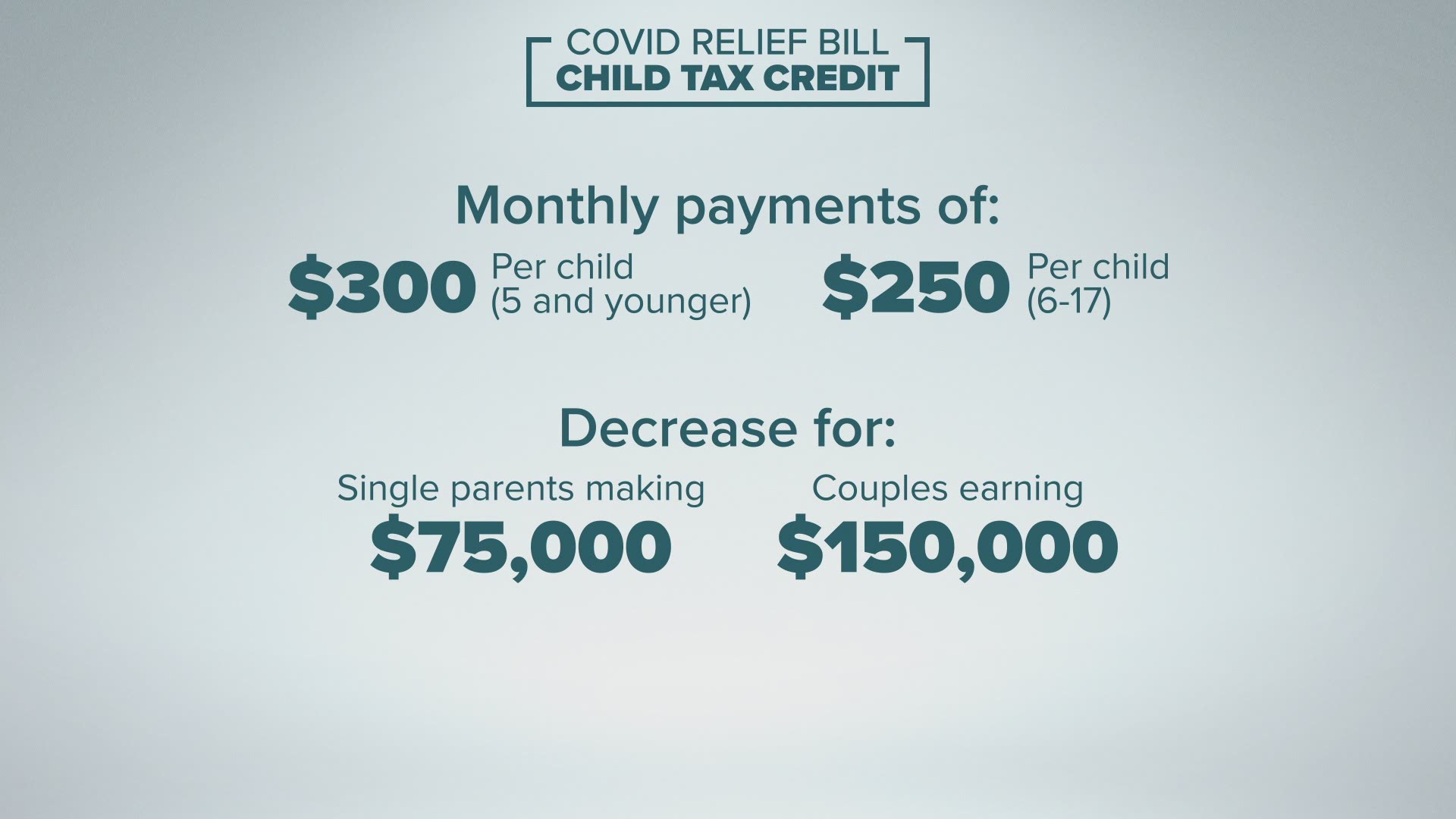

How Much Money Will Parents Receive Each Month. If you have children or other dependents under the age of 17 you likely qualify for the Child Tax Credit.

Solved How Much Federal Tax Will You Owe What Is The M Chegg Com

Solved How Much Federal Tax Will You Owe What Is The M Chegg Com

April 30 2021 at 120 pm.

How much money do you get for taxes per child. In some cases you could qualify for the Additional Child Tax Credit which is a. The child tax credit which is available if you have a dependent child under the age of 17 was increased to a 2000 credit under tax reform. The Child Tax Credit is one of the good credits that are refundable at least to some extent.

Under the TCJA the Child Tax Credit saw a substantial increase to 2000 per qualifying child. You can claim 500 for each child age 17 and 18 or for full-time college. American Rescue Plan Child Tax Credit Norm Elrod Stephen Nuñez Yeva Nersisyan CBS.

1400 of the credit is refundable. Standard Child Tax Credit Under the standard Child Tax Credit system all three families would be eligible for the same 6000 in tax credits. Up to 1400 of this amount is refundable depending on your income.

More Do You Qualify for the Child. Its 2000 per child as of 2018 and the IRS will send you the balance up to 1400 after it erases anything you might owe the IRS. You might be getting the Child Tax Credit--that is not a refund--it lowers the tax you owe up to 1000 per child but if you do not owe tax then you may not get the full amount of CTC.

To claim the full credit your annual income for 2017 must be less than 75000 as an individual filer or 110000 as a joint filer. Youre eligible for the Child Tax Credit in full as long as your income doesnt. If you meet those income requirements heres how much money you can claim for the earned income tax credit on your 2020 tax return.

Starting with the 2018 tax year there have been notable changes to. Here youll get up to 2000 per child under the age of 17 in your household up to 1400 of which is refundable. Child Tax Credit.

It was previously 1000 Greene-Lewis says. The Child Tax Credit is intended to offset the many expenses of raising children. How much you get per child In 2021 the Child Tax Credit offers up to 3000 per qualifying dependent child 17 or younger on December 31 2021.

This has doubled the previous amount and the Child Tax Credit was previously only refundable if you were also claiming the. 538 One qualifying child. Families with older kids are also eligible.

The Child Tax Credit can be worth as much as 2000 per child for Tax Years 2018-2025. The Additional Child Tax Credit has been eliminated in 2018. This credit reduces your federal income tax bill by up to 2000 per child for the 2020 tax year.

The Child Tax Credit for 2017 was limited to 1000 for each qualifying child. All About Child Tax Credits. The Child Tax Credit is a 2000-per-child tax credit given to a taxpaying parent with a dependent child under the age of 17.

If you have 2 children and one stays with you and the other stays with your ex-partner youll both get. If families split up If a family splits up you get 2115 a week for the eldest child. Families with kids age 17 and under will receive a credit of 3000 per child.

For Tax Years 2018-2025 the maximum refundable portion of the credit is 1400 equal to 15 of earned income above 2500.

Child Tax Credit Calculate How Much Money You Would Get With The The Child Tax Credit Stimulus Washington Post

Child Tax Credit Calculate How Much Money You Would Get With The The Child Tax Credit Stimulus Washington Post

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Child Tax Credit Expansion See If You Ll Get 500 3 000 Or 3 600 Per Kid Cnet

Child Tax Credit Expansion See If You Ll Get 500 3 000 Or 3 600 Per Kid Cnet

Child Tax Credit Calculator How Do You Calculate How Much Money You Have Memesita

Child Tax Credit Calculator How Do You Calculate How Much Money You Have Memesita

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

Child Tax Credit Expansion See If You Ll Get 500 3 000 Or 3 600 Per Kid Cnet

Child Tax Credit Expansion See If You Ll Get 500 3 000 Or 3 600 Per Kid Cnet

Child Tax Credit Income Limit And Age Info View Requirements Khou Com

Child Tax Credit Income Limit And Age Info View Requirements Khou Com

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

How Much Money Per Child For Stimulus 2021

How Much Money Per Child For Stimulus 2021

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

Child Tax Credits To Start In July What To Know Who S Eligible

Child Tax Credits To Start In July What To Know Who S Eligible

Stimulus Bill Could Mean 250 300 Monthly Checks Per Child Wtol Com

Stimulus Bill Could Mean 250 300 Monthly Checks Per Child Wtol Com

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment