Featured

3.6 Mortgage Rate

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. EDT and assume borrower has excellent credit including a credit score of 740 or higher.

Could Mortgage Rates Stay Below 4 Through 2020 Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Could Mortgage Rates Stay Below 4 Through 2020 Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The average APR on a 15-year fixed-rate mortgage fell 2 basis points to 2219 and the average APR for a 51 adjustable-rate mortgage ARM rose 6 basis points to 3472 according to rates.

3.6 mortgage rate. 30 Year Fixed Mortgage Rate - Historical Chart. The latest rate on a 15-year fixed-rate mortgage is 2637. The latest rate on a 71 conforming ARM is 4474.

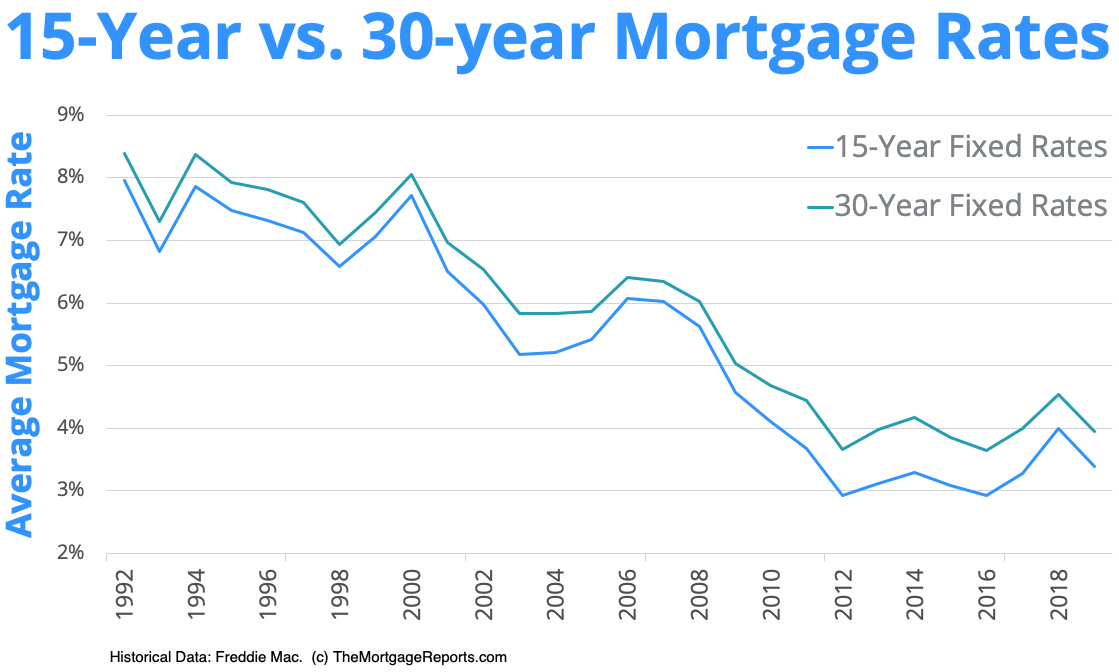

The 15-year fixed mortgage rate fell 1 basis point to 247 from a week ago. Mortgage rates valid as of 26 Apr 2021 1004 am. Again using the 30-year mortgage rates chart the payment on a 400000 loan amount at 350 is actually cheaper than the payment on a 300000 loan at 6.

The current 30 year mortgage fixed rate as of April 2021 is 298. Thats a one-day decrease of 0017 percentage points. Significant fees may apply.

ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for a 5y6m ARM 7 years for a 7y6m ARM. The latest rate on a 30-year fixed-rate mortgage is 36. Additional mortgage rates can be found in the chart and graph below.

What Homeowners Need to Know About Second Mortgages A second mortgage also referred to as a home equity loan or home equity line of credit is just what it sounds like. Cancel mortgage insurance When you purchase a home with less than 20 of the home price as your down payment youll likely pay private mortgage insurance PMI or a mortgage insurance premium MIP. A 36 ARM is a type of hybrid adjustable rate mortgage in which the initial fixed rate portion of the loan lasts 3 years after which the adjustable-rate part of the mortgage begins.

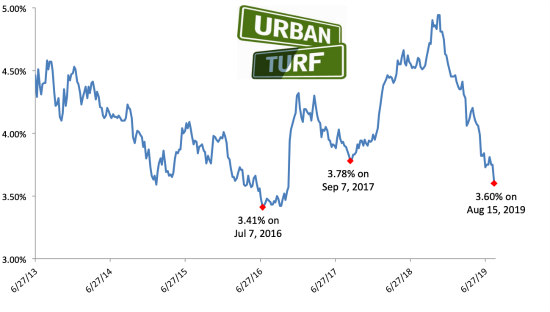

The 30-year rate is 36. When this article was published in late March that average stood at 309. 3-month trend 30-Year Fixed Rates.

The latest rate on a 51 jumbo ARM is 2968. Closing costs can cost 3-6 of the loan amount. Another second mortgage on your home.

Although the difference in monthly payment may not seem that extreme the 1 higher rate means youll pay approximately 30000 more in interest over the 30-year term. For example if you have an adjustable-rate mortgage ARM and the rate is about to increase you can change to a more stable fixed-rate mortgage. Use our Compare Home Mortgage Loans Calculator for rates customized to your specific home financing need.

11 rows ARM Floor rate 30. Select product to see detail. As youll see in the table below a 1 difference in mortgage rate on a 200000 home with a 160000 mortgage increases your monthly payment by almost 100.

Thats a one-month increase of 0264 percentage points. Housing economists say the growing optimism is putting upward pressure on rates. A 36 ARM is a type of hybrid adjustable rate mortgage in which the initial fixed rate portion of the loan lasts 3 years after which the adjustable-rate part of the mortgage begins.

So you can see where an individual who purchases a home while mortgage rates are super low can actually enjoy a lower mortgage payment than someone who buys when home prices are lower. Use annual percentage rate APR which includes fees and costs to compare rates across lendersRates and APR below may include up to 50 in discount points as an upfront cost to borrowers and assume no cash out. A Look Back a Look Forward Throughout 2020 mortgage rates generated a slew of headlines by dropping to record lows.

Cash-out refi interest rate. The industry groups forecast predicts that the average rate for a 30-year fixed mortgage loan could rise to around 36 by the fourth quarter of 2021. The Mortgage Bankers Association MBA says it believes the average rate for a 30-year mortgage will start at 29 in the first quarter of 2021 and gradually increase to 32 by.

Current 30-year fixed mortgage rates. The Mortgage Bankers Association for instance expects rates to reach 36 percent by the end of 2021. Maximum LTV of 90 and Maximum.

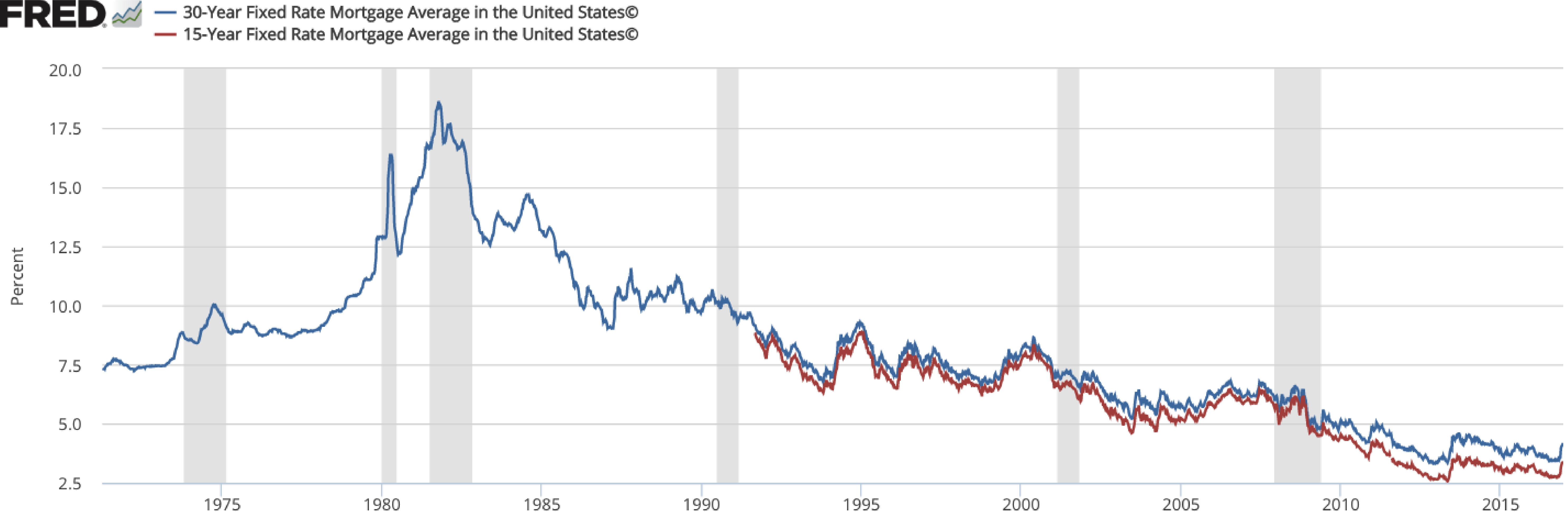

New monthly principal interest payment. Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since 1971.

350 A Month The Difference A Year Makes In Interest Rates

350 A Month The Difference A Year Makes In Interest Rates

History Of Us Mortgage Rates Texas Republic Bank

History Of Us Mortgage Rates Texas Republic Bank

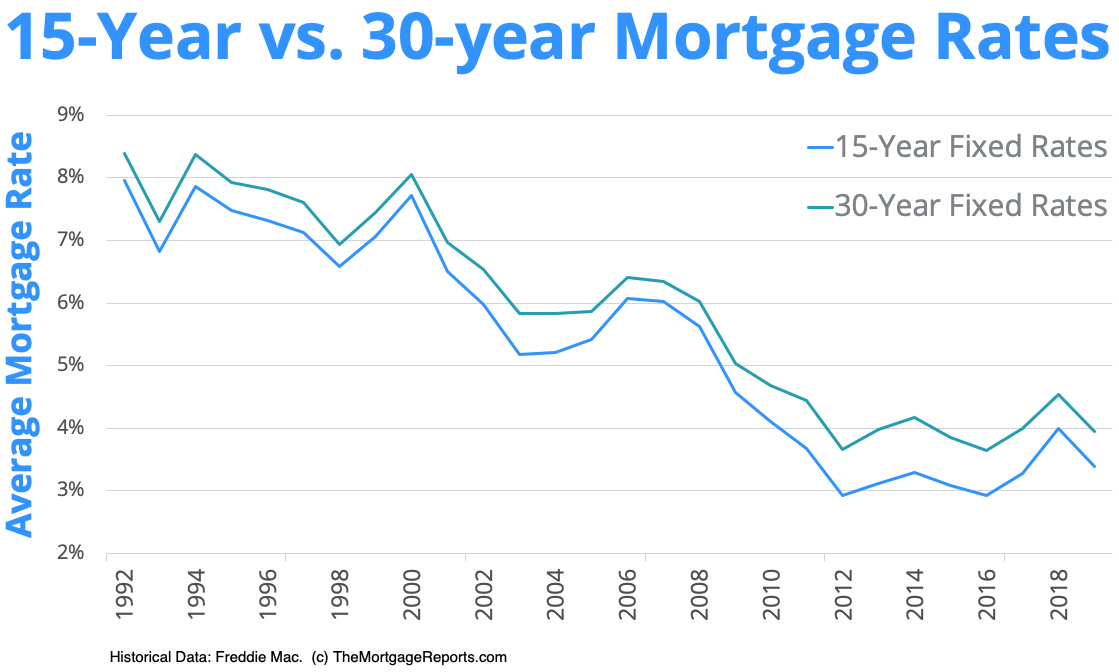

15 Year Mortgage Rate Charts Mortgage Rates Mortgage News And Strategy The Mortgage Reports

15 Year Mortgage Rate Charts Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Compare Today S Mortgage Rates Smartasset

Compare Today S Mortgage Rates Smartasset

Mortgage Rate Hits Record Low Of 2 88 National Mortgage News

Mortgage Rate Hits Record Low Of 2 88 National Mortgage News

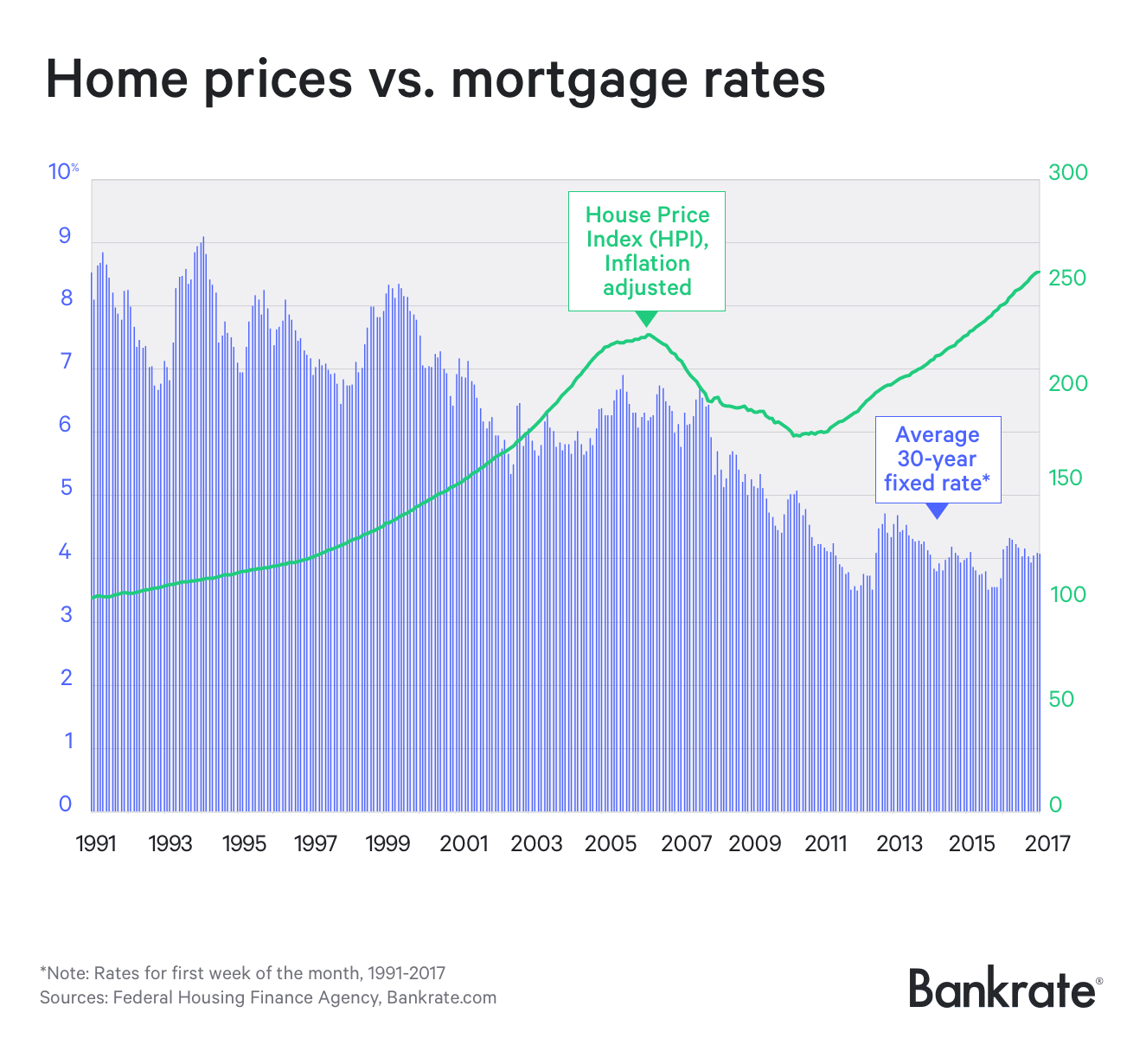

Do Rising Mortgage Rates Trigger Lower House Prices Bankrate Com

Do Rising Mortgage Rates Trigger Lower House Prices Bankrate Com

Average Mortgage Rates Unchanged But Future Drops Possible National Mortgage News

Average Mortgage Rates Unchanged But Future Drops Possible National Mortgage News

How Are Mortgage Rates Determined The Truth About Mortgage

How Are Mortgage Rates Determined The Truth About Mortgage

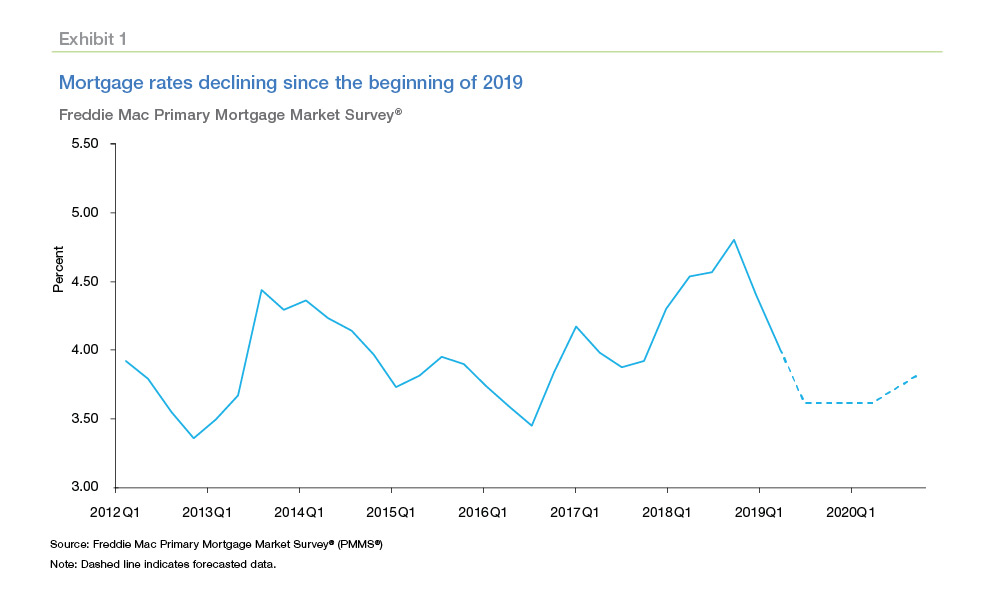

Low Mortgage Rates Strong Labor Market Fueling Housing Market Freddie Mac

How Your Credit Score Affects Your Mortgage Rate Chris Doering Mortgage

How Your Credit Score Affects Your Mortgage Rate Chris Doering Mortgage

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Current Mortgage Interest Rates April 2021

Current Mortgage Interest Rates April 2021

Housing Market Expected To Realize The Positive Impacts Of Low Mortgage Rates In 2019 Freddie Mac

Mortgage Rates Pulled Down To Lowest Levels In History The Washington Post

Mortgage Rates Pulled Down To Lowest Levels In History The Washington Post

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment