Featured

Tax Credit For Kids

3600 per child up to the age of 6 and 3000 per child between the ages of 6 and 17. The child tax credit has helped millions of Americans with the cost of raising children.

How Will The New Child Tax Credit Payments Work Forbes Advisor

How Will The New Child Tax Credit Payments Work Forbes Advisor

Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17.

Tax credit for kids. Enacted in 1997 the credit was established through the Taxpayer Relief Act. This will be the first time those with children aged 17 will receive the tax credit. For each qualifying child age 5 and.

The child tax credit will be available to parents with children under the age of 18. 4 rijen The Child Tax Credit is a refundable tax credit of up to 3600 per qualifying child. 3000 per kid ages 6 to 17 and 3600 for younger children.

A family of four making less than 150000 could. The child tax credit is a major component of the plan to lift millions of children out of poverty. The extra credit comes in two tiers.

Part of this credit can be refundable so it may give a taxpayer a refund even if they dont owe any tax. Length of residency and 7. Until now the credit was up to only 2000.

Child tax credit eligibility and income limits. This tax credit has helps millions of families every year and has been proposed to be expanded with the Trump Tax Reform. The enhanced tax credit is part of the 19 trillion American Rescue Plan that President Joe Biden signed into law in March.

The Child Tax Credit can significantly reduce your tax bill if you meet all seven requirements. The boost to the child tax credit will give eligible parents a total of 3600 for each child under 6 and 3000 for each child under age 18 for 2021. For 2020 the maximum amount of the credit is 2000 per qualifying child.

The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. The tax credit applies to children who are considered related to you and reside with you for at least six months out of the year. It increases the annual benefit per child 17 and younger to 3000 from.

According to the plan the legislation expands the Child Tax Credit from 2000 per child to 3000 per child for age 6 and above and 3600 per child for children under 6. Child tax credit 2021 qualifications Those with children between ages 6 and 17 are eligible for up to 3000 total per kid If you have dependents who are aged 6 or older youll qualify for up to. 4 rijen If you have a new baby in 2021 its counted towards the child tax credit If you have a baby.

But under the new rules they could receive the full 3000 or 3600. Families who qualify for the child tax credit can receive 3600 for children age 5 and under or 3000 for kids under the age of 17 kids older than 17 may qualify you for a partial payment. Some families will get a larger maximum credit.

You andor your child must pass all seven to claim this tax credit. Info to know A confusion some people may have is how their payments will be divided between 2021 and 2022. Under the current child tax credit if taxpayers credits exceed their taxes owed they only can get up to 1400 as a refund.

Single adults qualify for the full value of that larger credit if their annual income is. Those whose incomes are too high for the additional credit can still.

What Is The 2013 Child Tax Credit Additonal Child Tax Credit

Earned Income Tax Credit And Child Tax Credit 101 Center For American Progress

/child-and-dependent-care-tax-credit-3193008-v22-0582476abda64d80babcb8f67b52d734.png) Can You Claim A Child And Dependent Care Tax Credit

Can You Claim A Child And Dependent Care Tax Credit

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

Petition Bring Back Child Tax Credits For More Than 2 Children Change Org

Petition Bring Back Child Tax Credits For More Than 2 Children Change Org

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

Child Tax Credit 2021 How To Qualify What It Is Nerdwallet

Child Tax Credit 2021 How To Qualify What It Is Nerdwallet

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

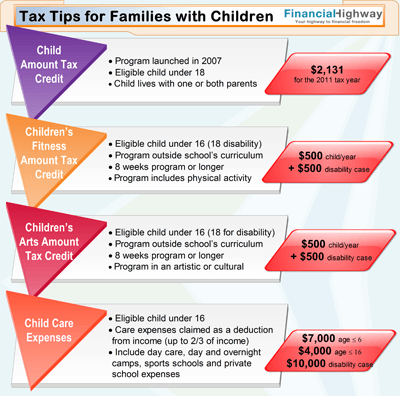

Tax Tips For Families With Children

Tax Tips For Families With Children

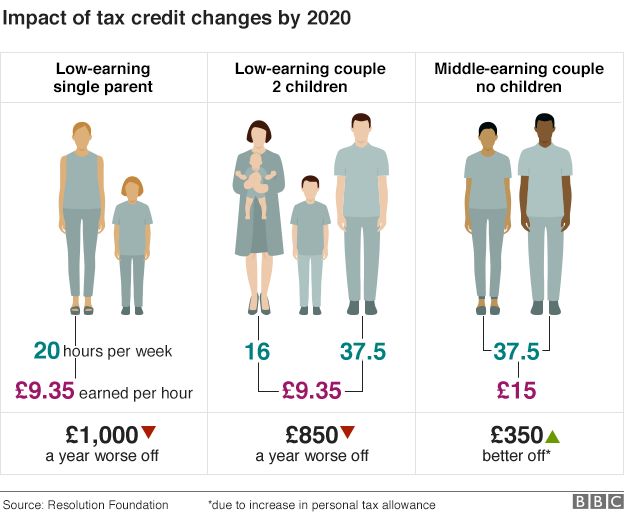

Tax Credits Winners And Losers Bbc News

Tax Credits Winners And Losers Bbc News

A New Child Tax Credit Would Put Us On The Road To A Stronger New Mexico New Mexico Voices For Children

A New Child Tax Credit Would Put Us On The Road To A Stronger New Mexico New Mexico Voices For Children

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment