Featured

- Get link

- X

- Other Apps

Do I Owe Federal Income Tax

Also if they owe money they will push ever deduction possible. This process verifies your financial information to ensure your taxes are accurate.

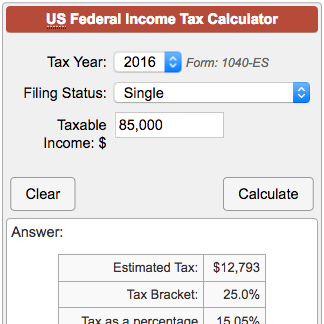

Us Federal Income Tax Calculator

Us Federal Income Tax Calculator

I am 46 - Answered by a verified Tax Professional.

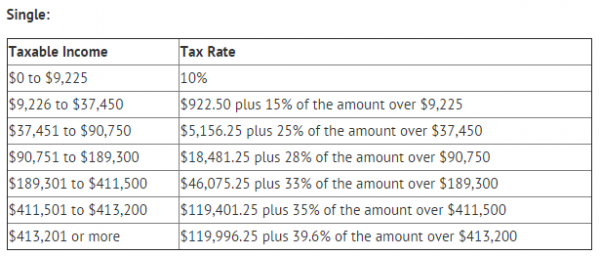

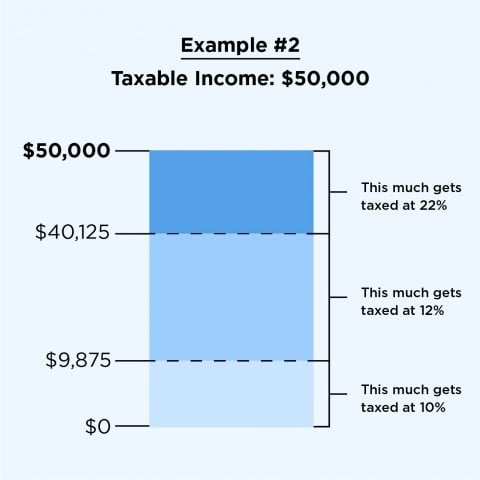

Do i owe federal income tax. Credit and Deduction Eligibility Income changes or students who were previously able to claim the American Opportunity Credit yet became ineligible due to an enrollment status change may also affect the tax situation. Actually you pay only 10 on the first 9875. Owing too much in taxes may also result in an IRS audit.

Federal taxes are the US. No the payment is not income and taxpayers will not owe tax on it. Feds make sure that you get a.

Under the IRS Fresh Start initiative individuals who owe 50000 or less in income tax and businesses that owe 25000 or less in payroll tax may qualify for an Online Payment Agreement. In 2019 individual income taxes accounted for approximately 50 of the federal governments nearly 35 trillion in total revenue according to. Tax credits directly reduce the amount of tax you owe dollar for dollar.

If you paid at least 90 of your taxes the fee is waived. The IRS will charge a late filing penalty a late payment penalty and interest on any unpaid balance you owe if you dont file your return or an extension on time and if you also fail to pay on timeBut youll avoid the late-filing penaltywhich is a hefty 5 of the taxes you owe for every month your return is lateif you file an extension by the April due date then file your return by. Once youve determined that you owe the IRS money its time to repay those back taxes.

Governments main source of funding. In the US both individuals and businesses must pay federal income tax. You pay 12 on the rest.

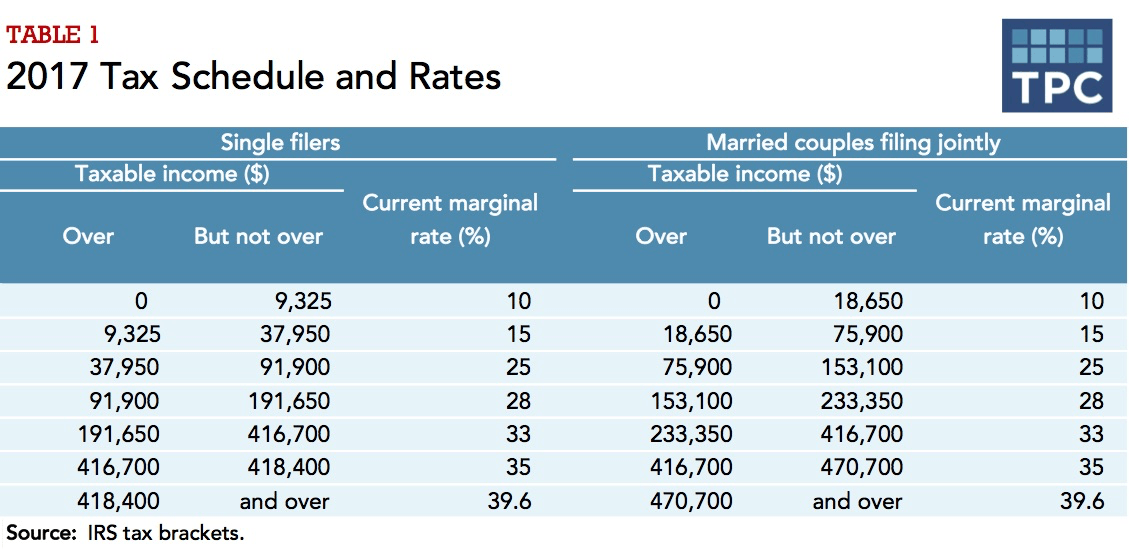

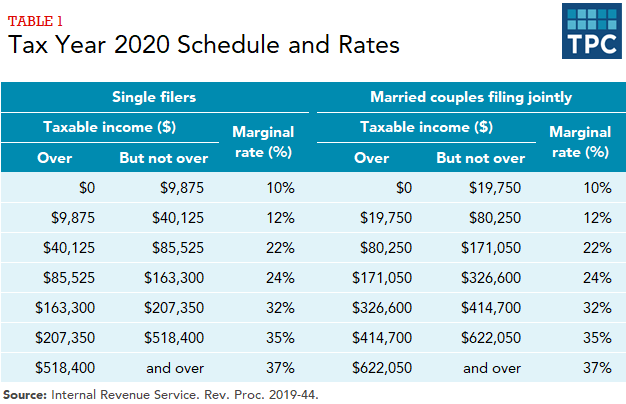

And Federal income taxes owed cannot be paid by a State income tax refund. Once you know the total amount you will owe in federal taxes the next step is figuring out how much you need to have withheld per pay period to reach that target but not exceed it by Dec. Marginal tax rates range from 10 to 37.

Enter your financial details to calculate your taxes. Income in America is taxed by the federal government most state governments and many local governments. Look at the tax brackets above to see the breakout Example 2.

That said the answer to why do I owe taxes this year might have to do with economic shifts due to the coronavirus pandemic. I need to know if my 2019 Federal taxes were accepted and am I getting a refund or do I owe. A tax credit valued at 1000 for instance lowers your tax bill by 1000.

Studies show that tax payers do not take legal deductions if they are getting a refund already. IOS 11 macOS 1012 and macOS 1013 VoiceOver users may experience difficulties when accessing this. The feds create withholding tables to over withhold.

We use cookies to give you the best possible experience on our website. The federal income tax system is progressive so the rate of taxation increases as income increases. The payment will not reduce a taxpayers refund or increase the amount they owe when they file their 2020 or 2021 tax return next year.

In Arkansas it is normal to pay state tax but get a federal refund. Refer to the accessibility guide for help if you use a screen reader screen magnifier or voice command software. Ideally youd be able to repay any outstanding tax bill plus fees and interest immediately Jaeger says.

In the somewhat longer words of the IRS. There are compatibility issues with some assistive technologies. You may owe taxes to the IRS if you are a freelancer and you havent been paying the estimated quarterly taxes.

State income taxes owed cannot be paid with a federal tax refund. Receiving unemployment income taking on an extra job or self-employment are all plausible causes for your refund amount changing from year to year. But if you were significantly off the mark on your tax payments youll likely owe money to the IRS.

Both reduce your tax bill but in different ways. Federal income taxes and State income taxes are totally separate.

4 Steps To Determine How Much Your Business Will Owe In Taxes Projectionhub

4 Steps To Determine How Much Your Business Will Owe In Taxes Projectionhub

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

47 Of Households Owe No Tax And Their Ranks Are Growing Sep 30 2009

47 Of Households Owe No Tax And Their Ranks Are Growing Sep 30 2009

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

Summary Of The Latest Federal Income Tax Data Tax Foundation

Summary Of The Latest Federal Income Tax Data Tax Foundation

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

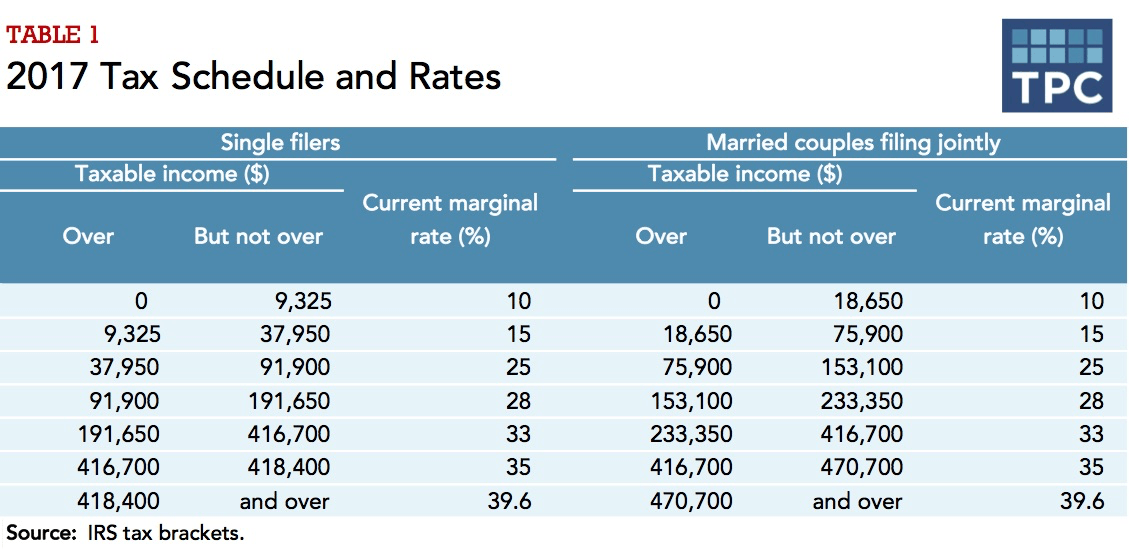

New Federal Income Tax Brackets 2019 How Much Am I Paying In Taxes

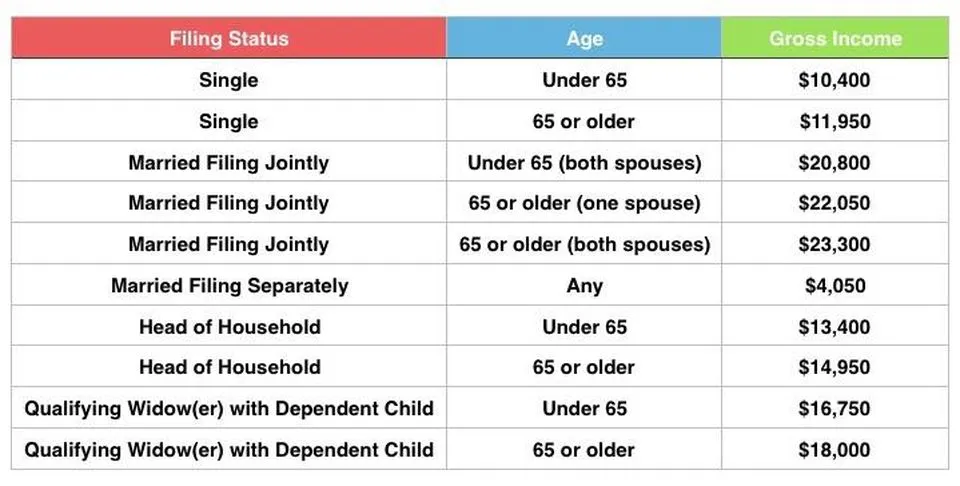

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

How To Calculate Federal Income Tax 11 Steps With Pictures

How To Calculate Federal Income Tax 11 Steps With Pictures

How Federal Income Tax Rates Work Full Report Tax Policy Center

How Federal Income Tax Rates Work Full Report Tax Policy Center

How Much Is Federal Income Tax How Much You Ll Pay Why Benzinga

How Much Is Federal Income Tax How Much You Ll Pay Why Benzinga

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png) How To Report And Pay Taxes On 1099 Nec Income

How To Report And Pay Taxes On 1099 Nec Income

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment