Featured

How Much Do Rates Have To Drop To Refinance

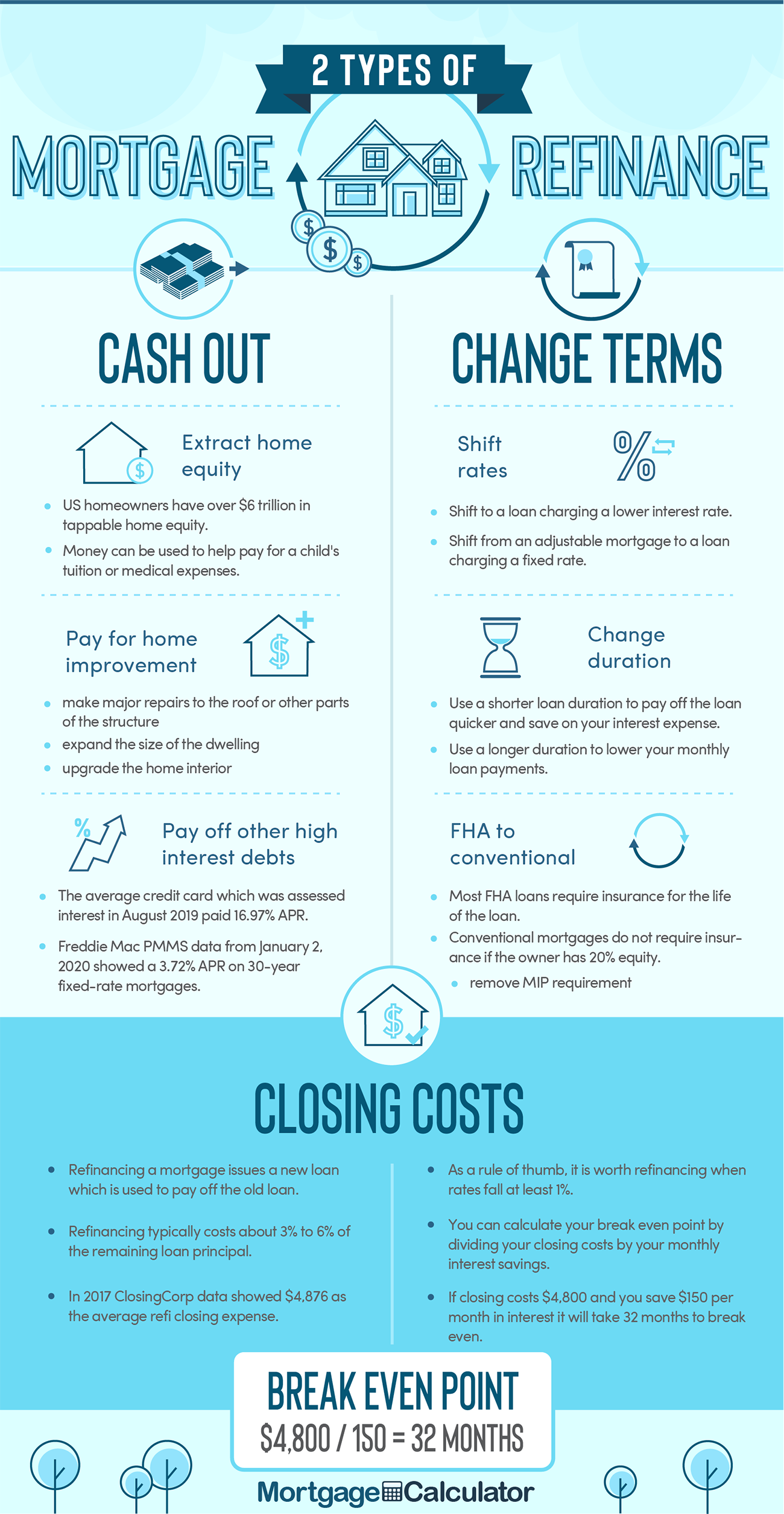

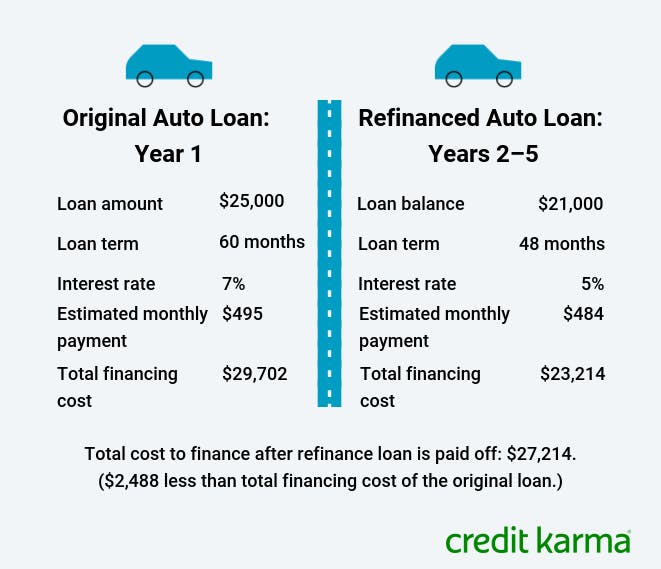

If you do pay some closing costs the math is just closing costsmonthly savings break even in months. The refinance share of all mortgage originations is predicted to drop to 41 in 2021 from 57 in 2020.

How Much Does The Interest Rate Have To Drop To Make A Mortgage Refinance Worth The Money Quora

How Much Does The Interest Rate Have To Drop To Make A Mortgage Refinance Worth The Money Quora

How much do rates have to drop in order to justify a refi.

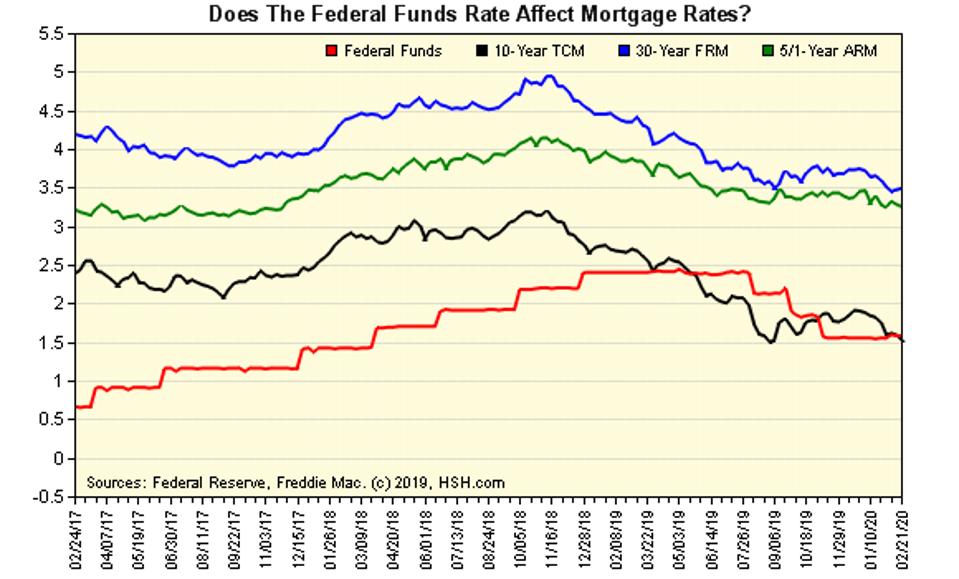

How much do rates have to drop to refinance. This means you could save 12000 over 10 years just by refinancing now. 4 Refinance mortgage rate. Consider that dropping your rate by just 10 puts about ten percent of your mortgage payment back into your pocket each month.

Homeowners with larger mortgage balances could achieve sufficient cost. But most homeowners are not budging. This depends more on just the interest rate drop.

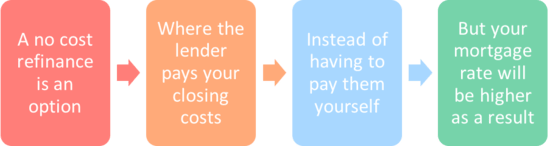

When mortgage rates drop homeowners often wonder if they will be able to take advantage of lower rates. In general lenders require borrowers to refinance into a new home loan in order to change their mortgage rate requiring the borrower to requalify the house to pass an appraisal and the homeowner to again pay closing costs. For the cost the best case scenario is to save money and refinance at no cost.

In response to Bankrates weekly poll 55 percent said rates will remain the same 27 percent said rates would fall and 18 percent said rates would rise. This means for every 1000 you pay the lender you could drop your payment by 100. You will still come out ahead with the new lender even if you lose 500 you already paid.

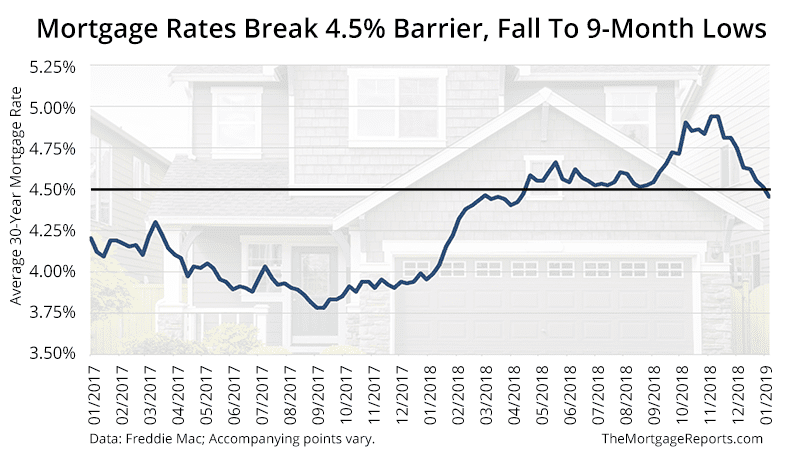

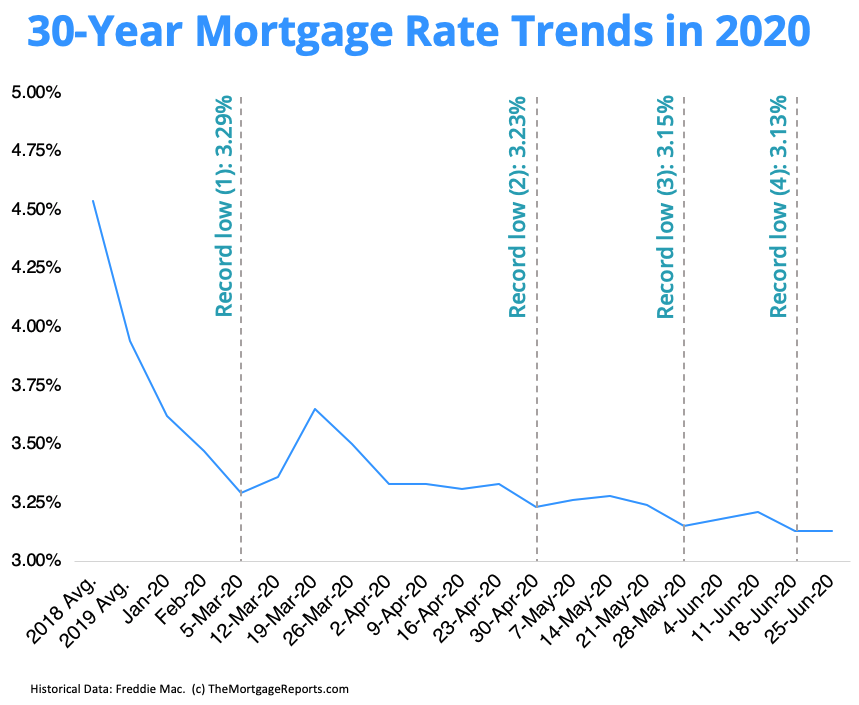

Mortgage interest rates are falling but theyll drop even more in the coming weeks giving some 18 million homeowners an opportunity to save money by refinancing. If refinanced to 3 the monthly mortgage payment falls to 210802. Refinance activity will depend on rates.

For example dropping your rate 1. One percent is a significant rate drop and will generate meaningful monthly savings in most cases. If it cost 3000 to refinance the homeowner would recoup the cost break even in about 26 months.

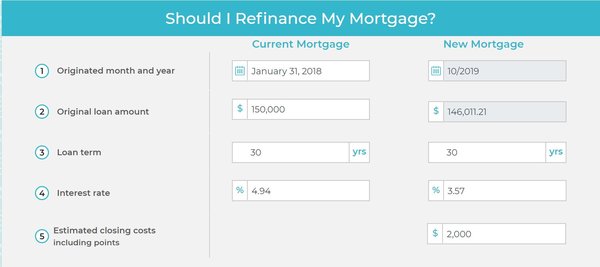

Lower the rate to 357 and the monthly cost falls to 67944. The loan fee is typically 1500 to 2000 and you often pay points on top of that to get the lower rate. In this scenario the existing mortgage payment is 238708.

30-year fixed-rate mortgage Current mortgage rate. 3 Cost to refinance. Thats a monthly savings of 12030 a month or 1444 per year.

However there can be another way to lower your mortgage. Its not a bad idea to consider refinancing your mortgage when interest rates are low and right now they are plummeting. However many lenders say 1 savings is enough of an incentive to refinance.

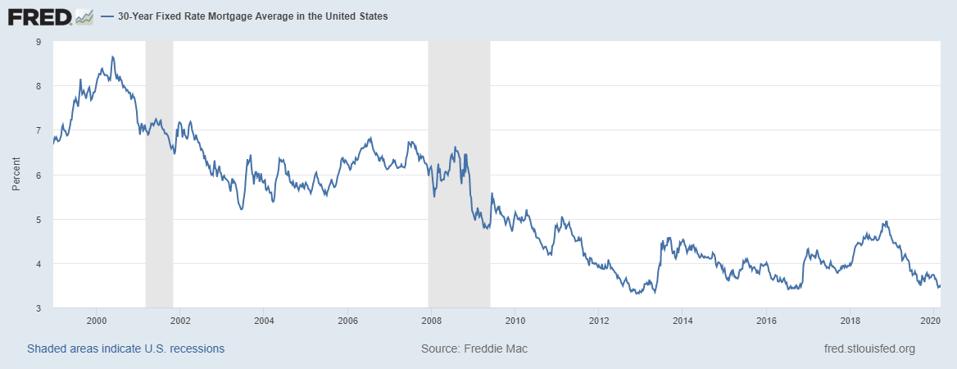

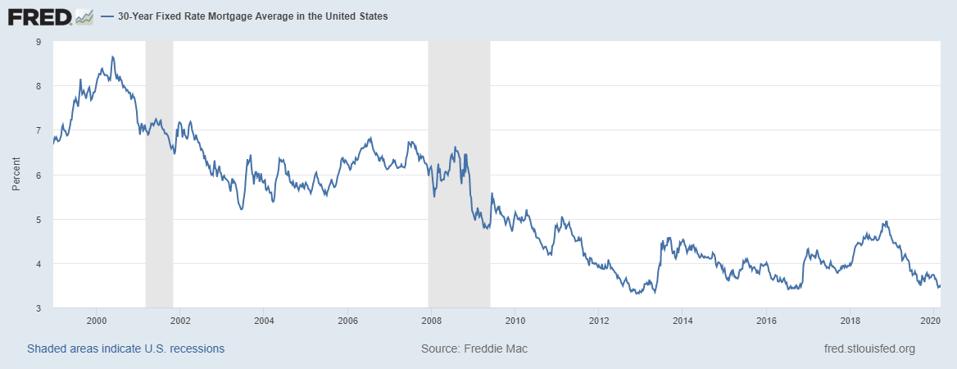

Given that rates are in the 3 range still even with a strong economy you would expect most homeowners would refinance. When interest rates drop consider refinancing to shorten the term of your mortgage and pay significantly less in interest payments. Within the mortgage industry the premise that your rate must drop by 2 percentage points to make refinancing worthwhile just doesnt add up.

Suppose you are expected to pay 5000 closing cost for your refinance. When mortgage interest rates drop more than a percentage or so some homeowners will decide to refinance their loans to get a better rate. Refinancing for a 1 percent lower rate is often worth it.

Consider that average interest rates on fixed-rate mortgages have ranged from less than 7 percent in the late 1990s to more than 15 percent in the early 1980s and you can see that refinancing can result in significant savings. You also have to look at how much the loan fee will be for refinancing and if youll have to pay points. A lower interest rate on your mortgage is one of the best reasons to refinance.

The homeowner with a lower current mortgage balance may need the 2 percent rate savings to have a refinance make sense. After the rate drops you may be able to get the same rate from a different lender for only 1000 closing cost. In July 2020 mortgage rates had dropped to 302.

When Should You Refinance Your Home. It doesnt make sense to continue and pay 5000. If the break even is relatively short not a big deal go for the refinance.

Rate Drop 7 Reasons To Refinance Your Home Now Academy Mortgage Corporation

Rate Drop 7 Reasons To Refinance Your Home Now Academy Mortgage Corporation

Home Mortgage Refinance Calculator Current Mortgage Loan Refinancing Rates

Home Mortgage Refinance Calculator Current Mortgage Loan Refinancing Rates

With Mortgage Rates So Low Is Now A Good Time To Refinance

With Mortgage Rates So Low Is Now A Good Time To Refinance

Mortgage Rates Drop Below 4 5 Homeowners Scramble To Refinance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Rates Drop Below 4 5 Homeowners Scramble To Refinance Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Rates Drop Under 4 Refinance Check 7 Million People Can Lower Mortgage Rate By 0 75 My Money Blog

Rates Drop Under 4 Refinance Check 7 Million People Can Lower Mortgage Rate By 0 75 My Money Blog

Mortgage Rates Hit New Record Low How Refinancing Now Could Save You More Money Fox Business

Mortgage Rates Hit New Record Low How Refinancing Now Could Save You More Money Fox Business

Should I Refinance My House Mortgage Rates Drop To 50 Year Low As Coronavirus Spreads Across The U S And The World Marketwatch

Should I Refinance My House Mortgage Rates Drop To 50 Year Low As Coronavirus Spreads Across The U S And The World Marketwatch

With Mortgage Rates So Low Is Now A Good Time To Refinance

With Mortgage Rates So Low Is Now A Good Time To Refinance

How A No Cost Refinance Loan Really Works The Truth About Mortgage

How A No Cost Refinance Loan Really Works The Truth About Mortgage

2 Mortgage Rates Real Or Marketing Gimmick Mortgage Rates Mortgage News And Strategy The Mortgage Reports

2 Mortgage Rates Real Or Marketing Gimmick Mortgage Rates Mortgage News And Strategy The Mortgage Reports

2 Million Borrowers Could Save Big Time Now That Refinance Rates Have Dropped

2 Million Borrowers Could Save Big Time Now That Refinance Rates Have Dropped

When Does Refinancing A Car Loan Make Sense Credit Karma

When Does Refinancing A Car Loan Make Sense Credit Karma

Is It Worth Refinancing For 0 5 Percent Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Is It Worth Refinancing For 0 5 Percent Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much Lower Should The Interest Rate Be To Refinance My Mortgage

How Much Lower Should The Interest Rate Be To Refinance My Mortgage

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment