Featured

How To Know If You Have An Inheritance

Invest smartly by shoring up short- and long-term financial goals. The answer depends on how you think the money might have been left to you.

How To Know If You Are Owed An Inheritance Bankrate Com

How To Know If You Are Owed An Inheritance Bankrate Com

The inheritance has to be reported to DWP once it hits their bank account until then the money is not theirs and DWP does not want to know.

How to know if you have an inheritance. Open an inherited IRA and transfer or roll over the funds into it. Without that seemingly simple step you may find one small splurge turns into many. Genealogy sites search obituaries the Social Security Death Master File and other sources for a record of a persons death.

However if you report it during probate it could cause DWP to suspend their claims until they get a letter from the solicitor to confirm it is still within probate. Withdraw the assets as a lump sum liquidate the account get a check. You can also contact the law firm directly and let them know their name and logo are being used in a scam.

Protect yourself from inheritance scams by being alert and suspicious. Just make sure to use the contact information on the firms website. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received.

Inheritance Tax IHT is paid when a persons estate is worth more than 325000 when they die - exemptions passing on property. Lets say youre on Baby Step 4 already investing a full 15 of your income for retirement you have 60000 left on your mortgage and you have two teenagers getting ready to go off to college in the next few years. If a deceased person left no spouse and no descendants then parents are next in line followed by siblings or their children and then auntsuncles or their children.

If the children have also passed away then their children inherit their share. Contact Mary Ann Covone PC Attorney at Law at 708-246-4911 or online today to schedule a free consultation. The list and the Government Legal Department cannot tell you if.

If you have no living relatives your estate becomes state property. However if the inheritance was real property like a family home or personal property like your great-grandmothers jewelry your relatives can buy it. If you want to know if you are entitled to an inheritance you should work with an estate planning attorney.

Receiving an inheritance is often complicated. Firstly its not really a case of whether you should tell Centrelink about your inheritance youre actually legally required to do so within 14 days of receiving the money. You might know someone personally who would help find the inheritance your mother mentioned that an executor from outside the family would not.

While an influx of cash or other assets might be welcome it may come at a time when you are grieving the loss of a loved one. Unfortunately if the inheritance was money or financial or bank account the money becomes property of the bankruptcy estate. If you have no immediate family your property is given to your next closest relatives.

I hope your dad kept his financial records organized. You can also. Also depending on the types of assets and other factors you may feel confusion or uncertainty about the.

So lets try to search for some of the facts. When most people ask whether they have an inheritance they are thinking of the probate estate of the deceased person also known as the decedent. You can report the email to the Federal Trade Commission or to the Internet Crime Complaint Center.

Sometimes known as death duties. So the first thing to do is to review the decedents probate case. Before you know it a.

Typically the division of assets starts with your spouse and then your children. Receiving an inheritance can trigger mixed emotions. 2 And finally an estate tax is a tax on the value of the decedents property.

On average an inheritance is gone in about five years because of careless debts and bad investment behaviors. So if you have a relative who passed away without a Last Will you could be entitled to an inheritance. If you receive a 200000 inheritance heres one way you might consider slicing that pie.

While the inheritance itself will not be considered income its a one-off payment unlikely to happen again what you do with it may fall under the income and assets test. They will help in researching making inquires and filing a petition to a court to make your claim. You can search the unclaimed estates list to see if you have any relatives who have an inheritance waiting for you.

Calculate how much you want to spend and on what. If you are named as the primary beneficiary you usually have four options regardless of what kind of retirement savings account you have inherited. Then be mindful of good long-term investment habits.

Inheritance Tax - GOVUK. Its paid by the estate and not the heirs although it could reduce the value of the inheritance. An inheritance tax is a tax on the property you receive from the decedent.

Roll over or transfer the assets to your own existing IRA.

Do You Have To Pay Estate Tax On Inherited Real Estate Millionacres

Do You Have To Pay Estate Tax On Inherited Real Estate Millionacres

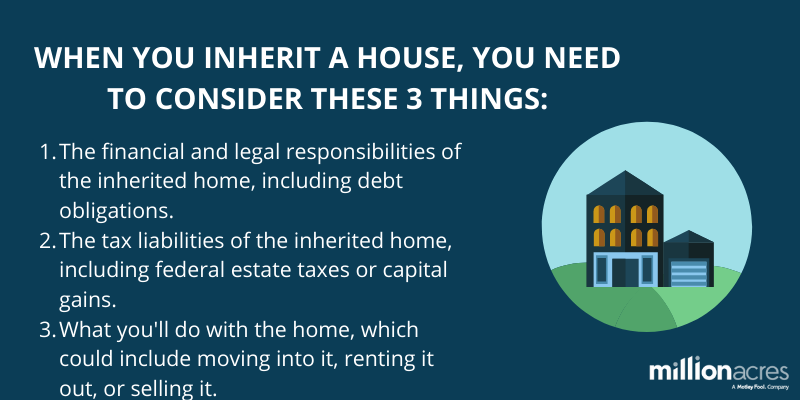

You Re Inheriting A House Now What Guide Millionacres

You Re Inheriting A House Now What Guide Millionacres

/will-you-have-to-pay-taxes-on-your-inheritance-6fc653662f34493991da5e21433cf537.png) Three Taxes Can Affect Your Inheritance

Three Taxes Can Affect Your Inheritance

/when-will-you-get-your-inheritance-3504965-FINAL-5b8813fc46e0fb0025520c3f.png) When You Will Get Your Inheritance After Someone Dies

When You Will Get Your Inheritance After Someone Dies

How To Find Out If You Have An Inheritance

How To Find Out If You Have An Inheritance

What You Need To Know When You Get An Inheritance Legalzoom Com

What You Need To Know When You Get An Inheritance Legalzoom Com

Do You Have To Pay Taxes On An Inheritance Bankrate Com

Do You Have To Pay Taxes On An Inheritance Bankrate Com

/when-will-you-get-your-inheritance-3504965-FINAL-5b8813fc46e0fb0025520c3f.png) When You Will Get Your Inheritance After Someone Dies

When You Will Get Your Inheritance After Someone Dies

/when-will-you-get-your-inheritance-3504965-FINAL-5b8813fc46e0fb0025520c3f.png) When You Will Get Your Inheritance After Someone Dies

When You Will Get Your Inheritance After Someone Dies

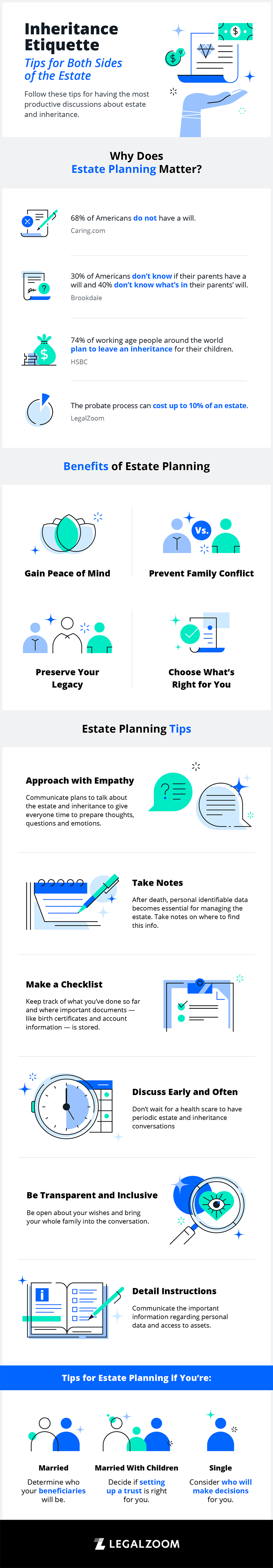

Inheritance Etiquette How To Talk About Estate Planning With Your Family Legalzoom Com

Inheritance Etiquette How To Talk About Estate Planning With Your Family Legalzoom Com

What You Need To Know About Inheritance Rights Everplans

What You Need To Know About Inheritance Rights Everplans

Inheritance Tax Who Pays Which States 2021 Nerdwallet

Inheritance Tax Who Pays Which States 2021 Nerdwallet

Millennials Will Inherit 68 Trillion By 2030 Here S What To Know If You Receive A Windfall

Millennials Will Inherit 68 Trillion By 2030 Here S What To Know If You Receive A Windfall

What Every Woman In India Must Know About Her Inheritance Rights Times Of India

What Every Woman In India Must Know About Her Inheritance Rights Times Of India

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment