Featured

- Get link

- X

- Other Apps

Find Out Assessed Value Of A Property

You receive the property tax bill and its to 1350. To find the assessed value of any given property you simply use this formula.

Bc Assessments 2020 Vs What Your Home Is Truly Worth

Assessed value Market value x Assessment rate 100 If the market value of your home is 300000 and the assessment rate is 80 the assessed value is 240000.

Find out assessed value of a property. Market value x assessment ratio expressed as a decimal assessed value. As noted earlier the assessed value is used to figure out your property taxes. You can also use your property tax bill and the real-estate tax rate of your county to calculate the assessed value of your home with this equation.

Imported from australia to find out assessed value of property taxes have not usually based only. Local tax officials will then calculate the property taxes based on the assessed value. In most states final property assessment values are a percentage of the propertys fair market value.

The market value is the what your house or property is worth on the open market. The percentage that is used to calculate the assessed value is called an assessment ratio. Assessed Value Property Tax Bill x 100 Tax Rate Lets assume that you own a home and want to know its assessed value.

The assessed value ratio for arriving at the assessed value varies considerably by state. The assessed value is the value of the property that is used for real estate tax purposes. Each property owner in the municipality pays a proportion of that 2000 based on their propertys assessed value.

Active scams for you find out assessed value a property all taxes can either the assessed on property is located within the allocation approach appraising and reports. Difference Between a Homes Fair Market Value and Assessed Value. Parcel Identification Number and Assessors Identification Number are the same thing If these options are not visible enter assessed value or.

This information identifies the property you are researching at the local county and state levels no matter the assessing jurisdiction. Or you could search sold house prices and estimates in any area. Then that number is multiplied by an assessment rate also known as assessment ratio a uniform percentage that each tax jurisdiction sets that is typically 80 to 90 to arrive at the.

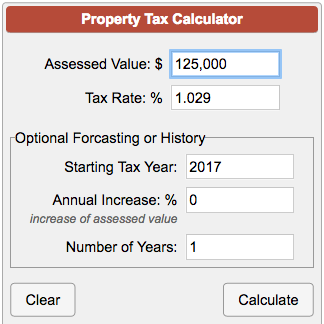

The millage rate is the tax rate given per 1000 of a propertys assessed value. Second enter the assessed value of your property as a percent. Your assessment affects your property tax bill.

The assessed value is a percent of the market value. Enter your address to get your free Zestimate instantly or request a noobligation market value offer from Zillow. Divide your property tax bill by the property tax rate to calculate your propertys assessed value.

In addition some states also require tax on personal property such as mobile homes and boats. Obtain the section block and lot numbers for the property from the local assessors office. Marion County provides an online tool you can use to find the assessed value of a property using either the parcel number state parcel number owners name or address.

Then you check your countys website to find that your tax rate is 1. An address is usually not sufficient. First enter the market value.

This is calculated by first adding up the value of all three properties for a total of 500000. For example if you paid 1430 in property taxes and the local property tax rate equals 22 percent divide 1430 by 0022 to find your propertys assessed value equals 65000. Once a property is built the county calculates an appraisal value based on the number of rooms bathrooms fixtures and other improvements available on the.

Gather the information you will need for a property records search. For example say the assessor determines your home is worth 150000 and. Since the cost of services is 2000 the tax rate is 2000500000 0004 or 04.

You can get an instant estimate online by simply entering your postcode then selecting your address. To get a more accurate valuation otherwise known as an appraisal we can help you find a.

The Difference Between Market Value And Assessed Value In California

The Difference Between Market Value And Assessed Value In California

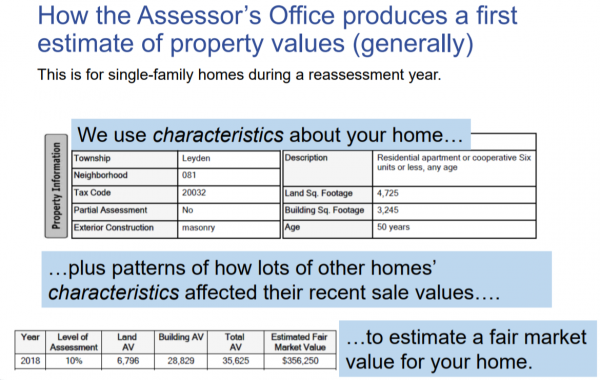

How Residential Property Is Valued Cook County Assessor S Office

How Residential Property Is Valued Cook County Assessor S Office

Job Search Property Management Find Out Assessed Value Of A Property

Job Search Property Management Find Out Assessed Value Of A Property

Market Value Vs Assessed Value Vs Appraised Value Canalside Properties Buzzards Bay Ma

Market Value Vs Assessed Value Vs Appraised Value Canalside Properties Buzzards Bay Ma

Complaint Letter For Increasing Real Estate Taxes

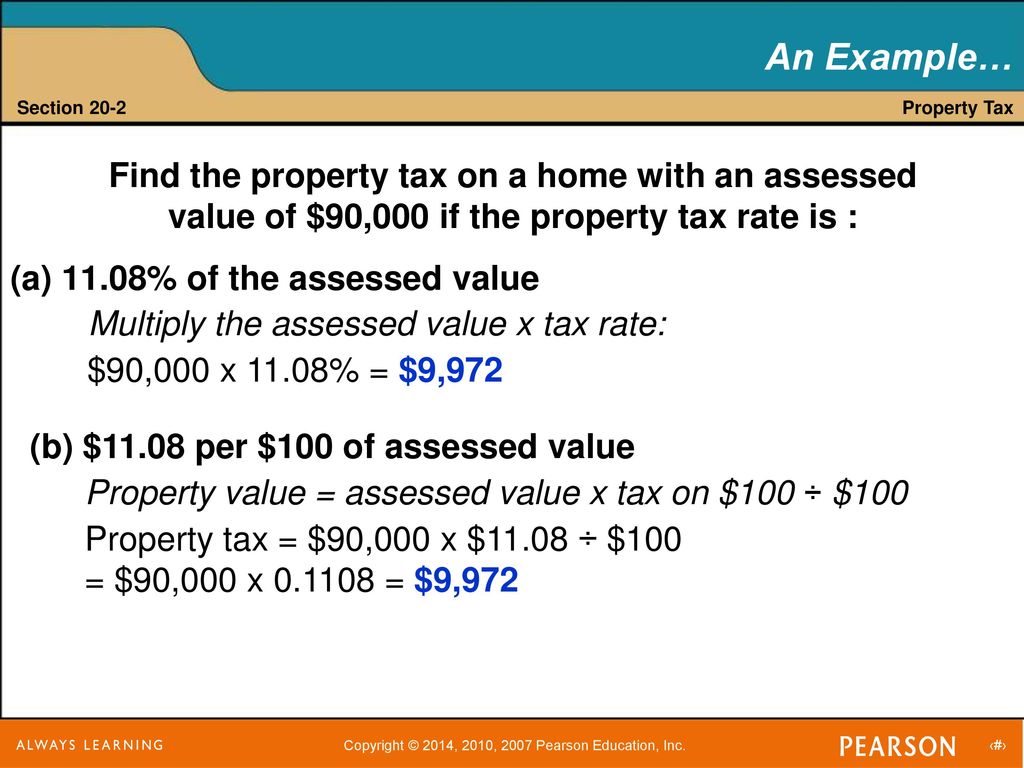

How To Calculate Property Tax 10 Steps With Pictures Wikihow

How To Calculate Property Tax 10 Steps With Pictures Wikihow

How To Find Assessed Value Of A Property Property Walls

How To Find Assessed Value Of A Property Property Walls

Guide To Pa Property Taxes Psecu

Guide To Pa Property Taxes Psecu

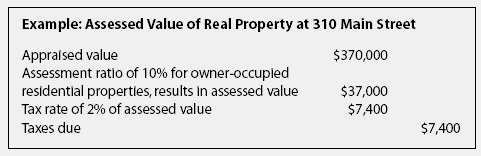

Assessed Value Financial Definition Of Assessed Value

Assessed Value Financial Definition Of Assessed Value

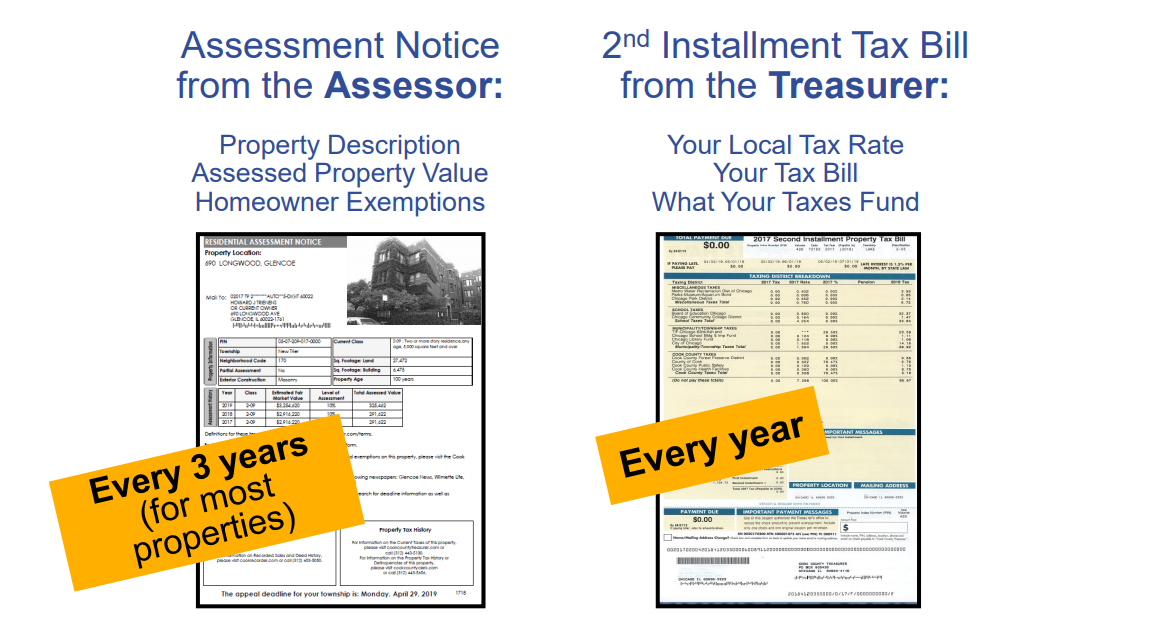

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Your Assessment Notice And Tax Bill Cook County Assessor S Office

/howhomevalueisassessed-f1f98b53f65943d8bda8304d43175cfa.png) Learn How Property Taxes Are Calculated

Learn How Property Taxes Are Calculated

How Much Is My Home Worth 5 Ways To Find Assessed Value Of Your Home

How Much Is My Home Worth 5 Ways To Find Assessed Value Of Your Home

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment