Featured

- Get link

- X

- Other Apps

Is The Irs Holding Refunds For 2021

If a taxpayer is owed money from the third stimulus the credit could be claimed on the 2021 tax return according to Mark Luscombe principal analyst for Wolters Kluwer Tax. They will then hold the returns until the IRS begins accepting them.

Irs Is Holding On To Millions Of Americans Tax Returns Delaying Refunds Cbs News

Irs Is Holding On To Millions Of Americans Tax Returns Delaying Refunds Cbs News

By law the IRS must withhold these returns until at least Feb.

Is the irs holding refunds for 2021. Deadline to file and pay your tax bill if you have one is May 17 2021. However that date represents the earliest possible date not the expected date. Wheres my tax refund.

If you feel like your 2020 tax refund is taking longer to arrive than usual youre not alone and you may well be right. That backlog is delaying tax refunds for many Americans. The IRS is holding 29 million tax returns for manual processing meaning theyll require human review according to the National Taxpayer Advocate an independent arm of the tax agency that serves as a consumer watchdog.

The repayments will come in phases continuing. Many factors can affect. The IRS will issue refunds automatically starting in May to workers who qualify for a new tax break on jobless benefits but had already filed their tax returns.

The IRS plans to refund any tax payments to individuals first followed by couples who filed jointly. The American Rescue Plan Act of 2021 was signed in March and temporarily revised the rules for taxation of unemployment benefits. Click here for a more complete list of important tax dates.

Deadline to file an extended return is October 15 2021. WAFB - Many Americans are still waiting for their tax refunds because the IRS is holding. More than 150 million tax returns are expected to be filed this year with the vast majority before the Thursday April 15 deadline.

While the IRS issues most tax refunds within 21 days of the filing season start its possible some refunds may take longer said IRS spokesman Robert Marvin. The first official day to file your 2020 tax return is February 12 2021. It allows eligible taxpayers to report up to 10200 of their.

But for some early filers the wait for a tax refund has been six weeks to eight weeks already. The information in this article is current through tax year 2020. However many tax software programs will allow you to complete your return and file it before that date.

The IRS is holding 29 million tax returns for manual processing delaying tax refunds for many Americans according to the National Taxpayer Advocate an. IRS hopes to clear tax refund backlog by summer IRS Commissioner Charles Rettig testified Thursday before the House Oversight Subcommittee on the 2021 filing season. 15th of the tax filing year.

Part of this law includes a section that requires the IRS to withhold tax refunds for taxpayers who file a tax return claiming either the Earned Income Tax Credit EITC and Additional Child Tax Credit ACTC. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. The goal here is to see if two tax returns are filed for the same individual.

26 2021 at 147 PM PDT. Typically the IRS sends most refunds within 21 days or less of taxpayers filing their return. IRS reportedly holding 30 million returns for manual processing IRS reportedly holding 30 million returns for manual processing Updated Apr 26 2021.

In an effort to combat this the IRS is now going to hold some refunds until February 15 2021. DFW News income taxes IRS Tax Refund Tax Return Texas News. Posted Apr 26 2021.

The goal here is to see if two tax returns are filed for the same individual. The IRS said last years average tax refund was more than 2500.

Tax Refund Schedule 2021 How Long It Takes To Get Your Tax Refund Bankrate

Tax Refund Schedule 2021 How Long It Takes To Get Your Tax Refund Bankrate

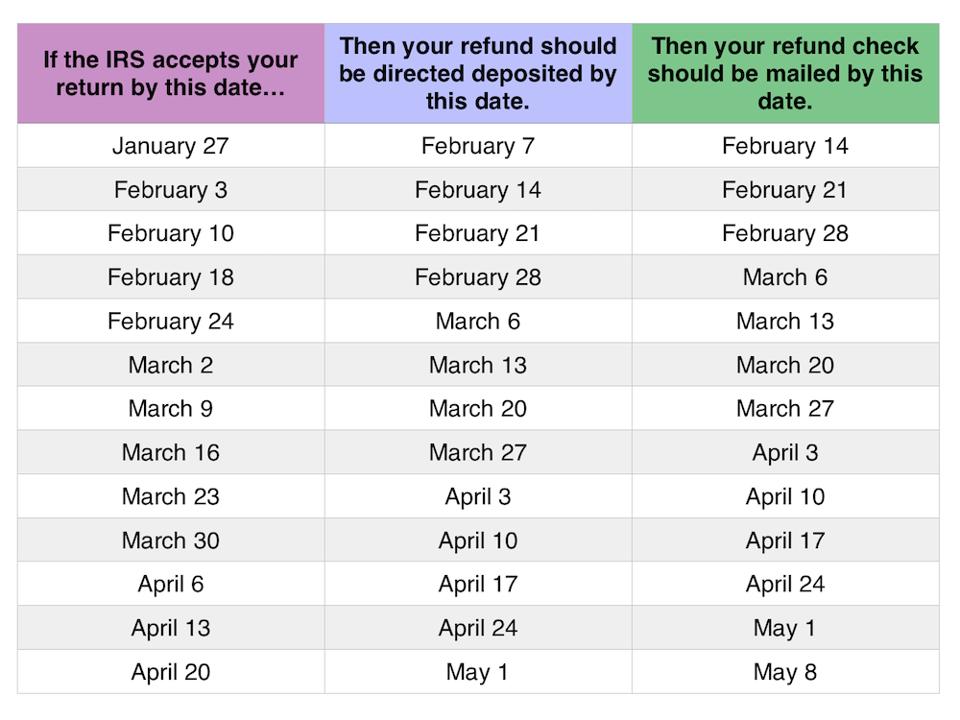

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

2020 Tax Refund Chart Can Help You Guess When You Ll Receive Your Money

2020 Tax Refund Chart Can Help You Guess When You Ll Receive Your Money

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

Tax Refund Delay What To Do And Who To Contact 2020 Smartasset

Irs Identity Check Why More Tax Payers Refunds Are On Hold

Irs Identity Check Why More Tax Payers Refunds Are On Hold

Why Your 2021 Early Tax Return Will Be Delayed This Year

Why Your 2021 Early Tax Return Will Be Delayed This Year

Irs Is Holding Millions Of Tax Returns Delaying Refunds Cbs Dallas Fort Worth

Irs Is Holding Millions Of Tax Returns Delaying Refunds Cbs Dallas Fort Worth

Where S My Tax Refund Irs Holds 29m Returns For Manual Processing

Where S My Tax Refund Irs Holds 29m Returns For Manual Processing

Irs Is Holding Over 29 Million Tax Returns Delaying Refunds For Many Poorer Americans

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Where S My Tax Refund Irs Reportedly Holding 30 Million Returns For Manual Processing Al Com

Where S My Tax Refund Irs Reportedly Holding 30 Million Returns For Manual Processing Al Com

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment