Featured

- Get link

- X

- Other Apps

Can I Refinance My Mortgage After 1 Year

When someone asks us Can I refinance right after buying a home the answer is yes but with reservations. Breaking your mortgage early will incur a large prepayment penalty though so mortgage refinancing is risky.

How To Refinance With Bad Credit Credit Com

Make sure to factor in your current loan term when considering refinance though.

Can i refinance my mortgage after 1 year. How soon you can refinance a mortgage depends on the type of home loan you have and the type of refinance mortgage youre getting. Based on recommendations and reviews identify three to five mortgage lenders and fill out a refinance application with each. When considering refinancing the more relevant question is how long should you wait before refinancing again.

If your beginning loan was a 30-year loan for example you can refinance into a loan lasting 20. Shop around with multiple lenders. You might refinance your mortgage to get a lower rate access equity in your home or consolidate your debts.

This means paying extra interest even if. Only a few lenders are likely to approve refinancing if you have been in your current mortgage for less than a year. In some circumstances however you may need to wait.

So you can get a loan for 80 of your homes appraised value. To minimize credit score impacts complete your. Heres a quick rundown on how to refinance a mortgage.

How soon can you refinance a home after purchase. However most lenders wont refinance a mortgage they issued in the last 120-180 days so you may have to shop for a new lender. With a fixed mortgage rate of 4702 youd spend 347012 in interest alone over the next 30 years.

The most straightforward way to do this is by refinancing your mortgage into a shorter loan term. Both types of bankruptcy have a specific time frame during which you cannot get a mortgage loan or refinance. I just refinanced my mortgage after about 1 12 years - originally 425 for 15 years down to 3375 at 15 years with no closing costs had to pay for the appraisal though.

You must wait at least 2 years after the discharge or dismissal date before you can refinance your loan. When Can I Refinance My Home. The 2o2o conforming limit for all counties in Illinois is 510400.

If you have a conventional loan then a rate and term refinance should give you the customization you need. If you want to do a cash-out refinance and gain access to some of the equity you have in the home the waiting period can be at least six months after your current mortgage loan closed. Switching loan types is helpful when your situation changes.

The only caveat is that you might have to wait six months from your most recent closing whether it. Some mortgages let you refinance immediately after getting the. If youve completed your waiting period and meet the general lending requirements its time to apply for a mortgage refinance.

A mortgage refinance is when you break your current mortgage and start a new one either with the same or a new lender. Mortgage companies cannot prohibit a homeowner from refinancing a mortgage. It may seem foolish to refinance soon after you went through the process and paid closing costs on your original mortgage but in some cases it could save you big money over the life of the loan.

For instance if youre four years into a 30-year mortgage and refinance to a new 30-year term it will have taken you 34 years total to pay off your home in the end. While you can legally refinance at any time there may be some costly consequences to this decision. Many lenders will require at least a year of payments before refinancing your home.

Refinance closing costs can range from 2 to 6 of your loan amount and it can take at least a few years to recoup those costs. 1 2020 for most conventional loans. If you are going to get a conventional mortgage backed by Fannie Mae or Freddie Mac the maximum Loan to Value LTV for a cash-out refinance on a primary residence is 80.

Some refuse to refinance in any situation within 120 to 180 days of issuing the loan. If after nine years you refinance into a new mortgage with a. However mortgage companies can make it costly for a homeowner to refinance before a certain time period expires.

Explore restrictions with your current lender to understand your refinancing. Remember that any refinancing after the enactment of the Dodd-Frank Act in 2014 that has a prepayment penalty attached to it should only be effective for three years and cannot be more than 2 of the total amount of the loan during the first two years after refinancing it. The answer may be sooner than you think although it depends on the refinance program youre looking for the loan type and if any penalties apply.

Conventional mortgages come with a limitations on just how big of a mortgage you can obtain though. Can I Refinance After Owning My Home for One Year. Theres also a new adverse market refinance fee which equals 05 of the loan amount going into effect Dec.

Waiting Periods To Refinance You cant refinance until your bankruptcy waiting period is over. Sure you can refinance your mortgage a second time a third time and so on. The traditional rule of thumb says to refinance if your rate is 1 to 2 below your current rate.

This then drops to. But even if there arent any fees to refinance each time you do it youre essentially restarting your loan which pushes you farther from the finish line. Depending on the situation its possible to refinance a mortgage loan immediately.

You can refinance your mortgage as many times as it makes financial sense to do so.

How Soon Can I Refinance My Home Mortgage I Did The First Year

How Soon Can I Refinance My Home Mortgage I Did The First Year

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

How Soon Can I Refinance My Mortgage The Truth About Mortgage

How Soon Can I Refinance My Mortgage The Truth About Mortgage

Refinance Your Mortgage Without Starting Over At 30 Years

Refinance Your Mortgage Without Starting Over At 30 Years

How Much Lower Should The Interest Rate Be To Refinance My Mortgage

How Much Lower Should The Interest Rate Be To Refinance My Mortgage

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

Should I Refinance My Mortgage Beginner S Guide To Refinancing Your Home Loan

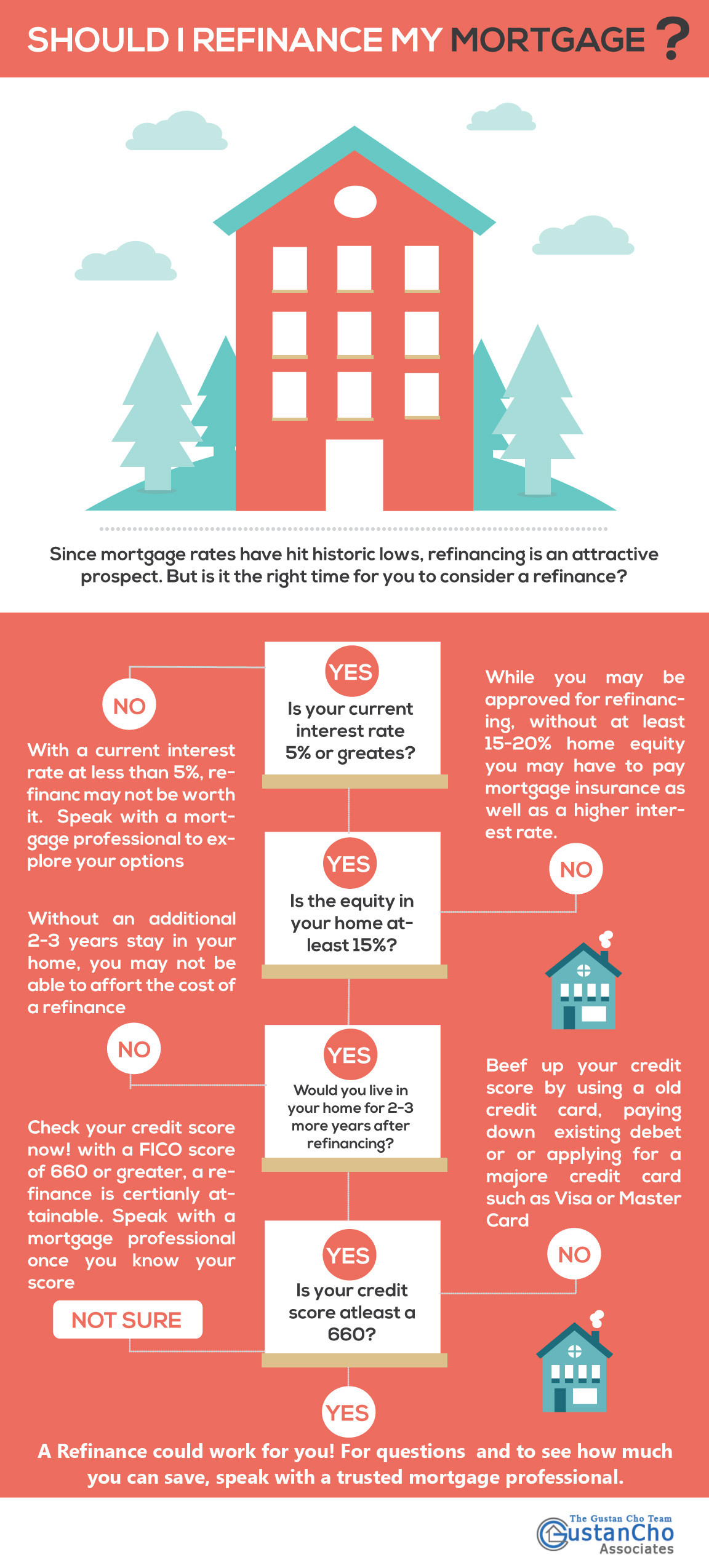

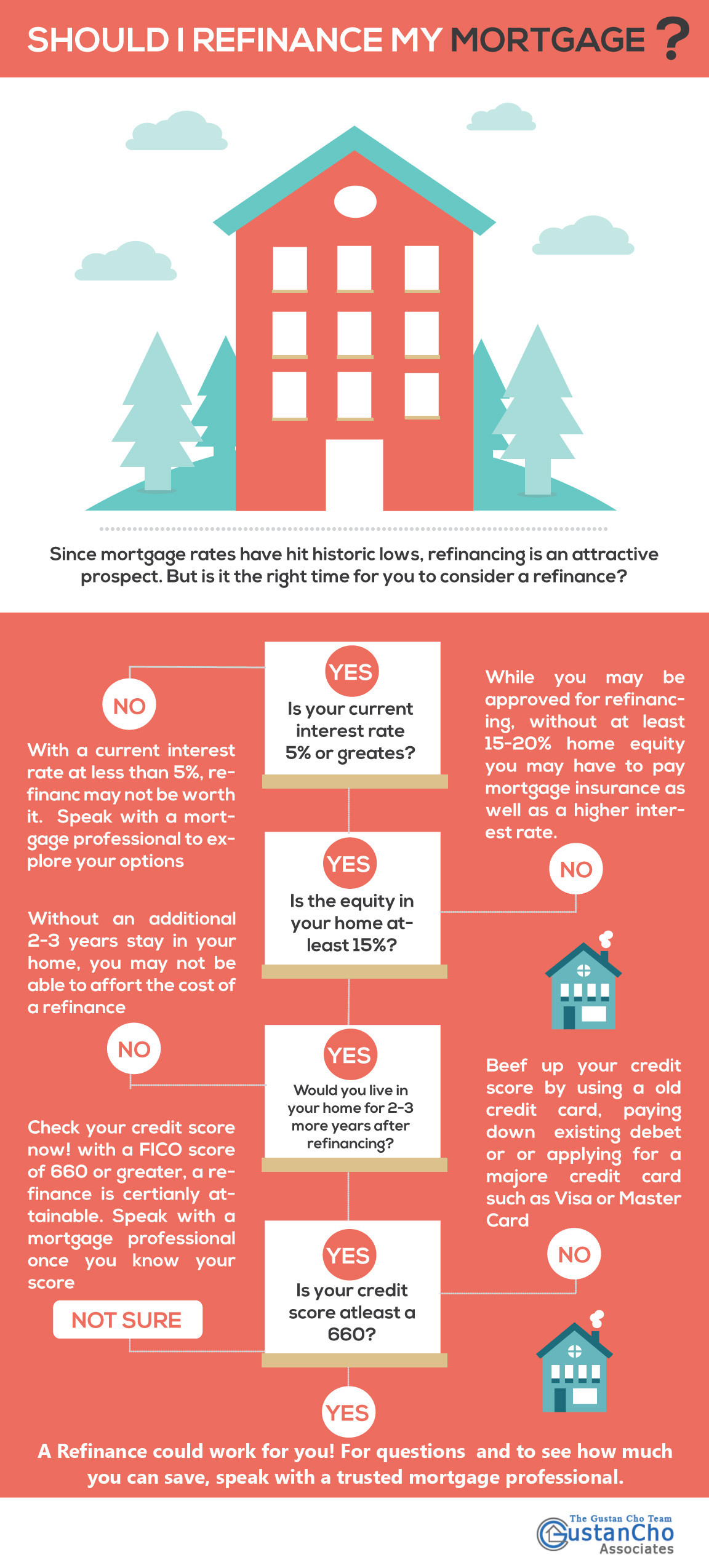

Should I Refinance My Mortgage Infographic Rates At 3 Year Low

Should I Refinance My Mortgage Infographic Rates At 3 Year Low

Should I Refinance My Mortgage When To Refinance Mint

Should I Refinance My Mortgage When To Refinance Mint

How Soon Can I Refinance My Home Mortgage I Did The First Year

How Soon Can I Refinance My Home Mortgage I Did The First Year

Should I Refinance My Mortgage Ramseysolutions Com

Should I Refinance My Mortgage Ramseysolutions Com

What It Took To Successfully Refinance My Mortgage

What It Took To Successfully Refinance My Mortgage

Should I Refinance My Mortgage Finder Canada

Should I Refinance My Mortgage Finder Canada

How Soon Can You Refinance No Waiting Period For Some Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Soon Can You Refinance No Waiting Period For Some Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment