Featured

What Should My Apr Be On My Mortgage

For example the APR on a 30-year loan assumes that youll keep the loan for the full 30 years. A lower APR could translate to lower monthly mortgage payments.

How Are Mortgage Rates Determined The Truth About Mortgage

How Are Mortgage Rates Determined The Truth About Mortgage

APR may also include prepaid interest any loan application fee any underwriting fee and other lender charges.

What should my apr be on my mortgage. This includes financing charges and any fees or additional costs associated with the loan such as closing costs or points. The apr is a reflection of the total cost of the loan including fees and mortgage insurance. APR is higher than the.

Federal law says lenders should not include these finance charges in a mortgage APR. Thats why you have to stay in the home during the course of the loan eg. Some fees are not considered financing charges so you should check with your lending institution.

The annual percentage rate APR on a mortgage is a better indication of the true cost of a home loan than the mortgage interest rate by itself. While nominal rate is used to calculate the interest the APR is the rate that includes all the actual charges not only interest. Meanwhile advertised mortgage rate Y is offered with no points and just 1000 in closing costs so the APR is 4836 just below that of mortgage rate X So even though one advertised mortgage rate might be lower than another once closing costs are factored in it could actually end up costing you more.

Mortgage APR Calculator. Thats because an APR not only takes your interest rate into account but also factors in other costs such as most closing costs and lender fees. This is because the TIP is based on the total interest you would pay over the full term of the mortgage while the interest rate and APR are annual rates.

Youll see APRs alongside interest rates in todays mortgage rates What APR should I get for a mortgage. The difference between the quoted rate and the APR comes from the fees and points. APR Assumes a Long-Term Relationship.

However it should not be the only defining factor. The APR takes into account not only the mortgage rate but also things like closing costs discount points and other fees that are charged as part of the loan. Your interest rate is simply the interest based off of the principal.

Annual percentage rate or APR reflects the true cost of borrowing. Its because this rate is based on long-term assumptions and the fees spread out during the life of the loan. For example the first loan should cover 80 of the price while the second loan covers 10.

The rate on a cash-out refinance for 180000 is 8 and if there are no fees the APR is 8. Setting a budget Once you have a budget set you can better estimate what a monthly mortgage payment would be. 1 Example allocations based on net monthly income.

Understanding APR on a mortgage A home loans annual percentage rate APR is also displayed as a percentage but is higher than the accompanying interest rate. Your APR will determine how much you end up paying for your mortgage because it covers your mortgage interest rate and all the fees to be paid to your lender andor broker. A comparison of APRs suggests that the cash-out refinance is cheaper but it isnt.

Mortgage APR includes the interest rate points and fees charged by the lender. APR is the annual rate that is charged for a loan representing the actual yearly cost of a loan over the term of the loan. So if youre quoted rate 475 but the APR is 5795 it means that you have a yearly overhead of 1045 over the stated rate.

An alternative would be to try the piggyback mortgage. An APR is most potent when comparing long-term loans like 30-year mortgages. Dont forget to consider the note interest rate loan length and actual loan costs when shopping for a mortgage.

The higher the APR the higher the mortgage cost. Both numbers tell you something useful about what you will pay. APR seems to matter a lot more with conventional loans but with FHA loans all the costs are pretty uniform from bank to bank so its less important to look at.

The rate on a second mortgage of 20000 is 9 and if there are no fees the APR is 9. In general borrowers today can expect an APR in the neighborhood of 25 percent to 35 percent depending on the. APR is a loan-comparison tool that measures all the costs of a mortgage including the interest paid over the life of the loan origination fees and points.

30 years or more to fully enjoy the benefit of a low APR and the low monthly payments it brings. In reality many people do not keep their loans for the entire term. Bankrates mortgage rate table can help in your research.

APR calculations assume that a loan will be paid off over its entire lifetime. A 100000 loan with a 4 percent fixed interest rate for example could have an APR of 425 percent and a TIP of 72 percent. You can certainly use the APR to help determine the best mortgage loan for your needs.

Combined with these factors the APR helps give transparency to the loan terms. The annual percentage rate APR is the amount of interest on your total mortgage loan amount that youll pay annually averaged over the full term of the loan.

Seven Factors That Determine Your Mortgage Interest Rate Consumer Financial Protection Bureau

Seven Factors That Determine Your Mortgage Interest Rate Consumer Financial Protection Bureau

/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png) Compute Loan Interest With Calculators Or Templates

Compute Loan Interest With Calculators Or Templates

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png) What Apr Tells You About A Loan

What Apr Tells You About A Loan

How To Shop For A Mortgage And Compare Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Shop For A Mortgage And Compare Mortgage Rates Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law

Current Mortgage Interest Rates April 2021

Current Mortgage Interest Rates April 2021

/what-is-a-fixed-rate-mortgage-3305929-Final2-3c46c75609a940939cca58b8e47f669f.png) Fixed Rate Mortgage What Is It

Fixed Rate Mortgage What Is It

Mortgage Amortization How Your Mortgage Is Paid Off The Truth About Mortgage

Mortgage Amortization How Your Mortgage Is Paid Off The Truth About Mortgage

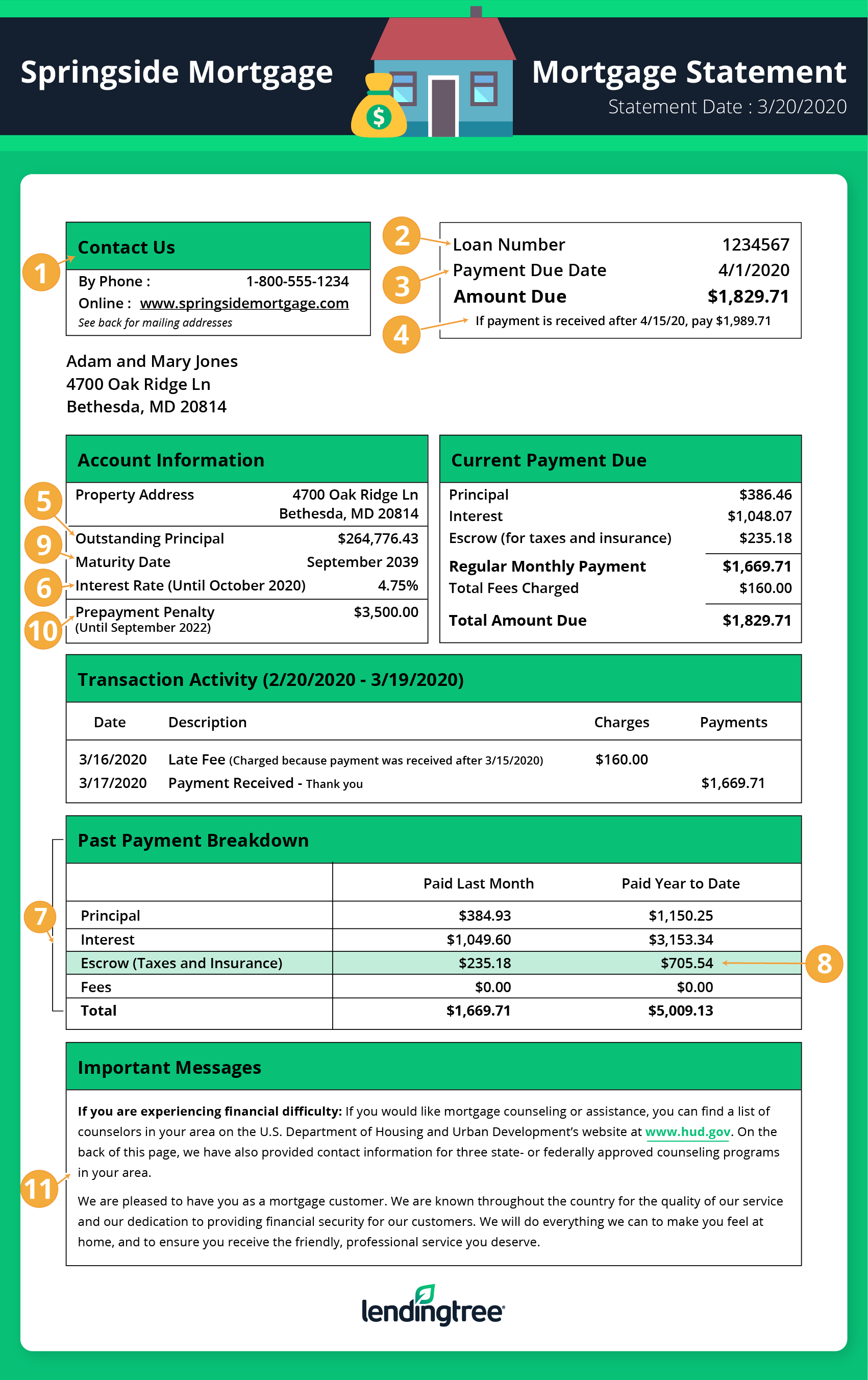

How To Read A Monthly Mortgage Statement Lendingtree

How To Read A Monthly Mortgage Statement Lendingtree

/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png) How A Credit Score Influences Your Interest Rate

How A Credit Score Influences Your Interest Rate

How Much Does A 1 Difference In Your Mortgage Rate Matter

How Much Does A 1 Difference In Your Mortgage Rate Matter

What Are Mortgage Points And How Do They Work

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment