Featured

Irs Loan Repayment

Treat loan payments sent directly to the educational institution as paid on the date the institution credits the students account. IRS would collect loans through the tax system whenever borrowers elected to repay through employer wage withholding.

Irs Allows 401 K Match For Student Loan Repayments

Irs Allows 401 K Match For Student Loan Repayments

The dollar value of this benefit is the gross amount credited to the employee at the time of a loan payment to the holder of the student loan before.

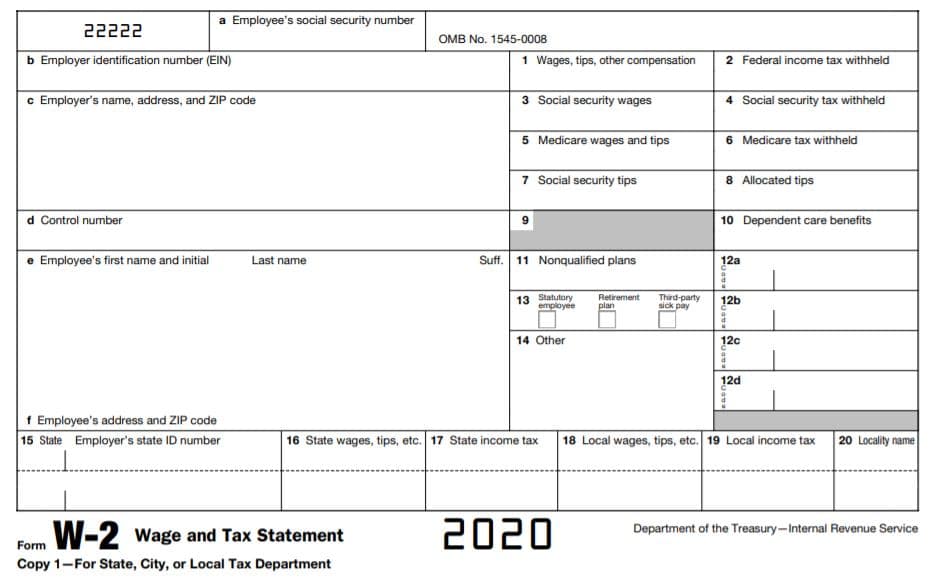

Irs loan repayment. A QPLO occurs when a participants account balance in a qualified retirement plan such as a 401k plan is reduced to repay a plan loan and that reduction occurs solely due to termination of the plan or the participants failure to meet the loans repayment terms because of. Use the expenses to figure the American opportunity credit for the year in which the expenses are paid not the year in which the loan is repaid. A plan loan offset is considered an actual.

43 fee which may be reimbursed if certain conditions are met. A plan loan offset occurs when pursuant to the loan terms a participants benefit is reduced to repay the loan. Under employer student loan repayment programs employers help employees pay back their student loans in amounts that vary from company to company.

If a loan is outstanding on or after March 27 2020 and any repayment on the loan is due from March 27 2020 to December 31 2020 that due date may be delayed under the plan for up to one year. A 1 The Secretary acting through the Service shall establish a program to be known as the Indian Health Service Loan Repayment Program hereinafter referred to as the Loan Repayment Program in order to assure an adequate supply of trained health professionals necessary to maintain accreditation of and provide health care services to Indians through Indian health programs. If method 2 results in less tax claim the credit figured in 3 above on Form 1040 or 1040-SR.

If the employee is unable to repay the loan then the employer will treat it as a distribution and report it to the IRS on Form 1099-R. Loans to an employee that leaves the company Plan sponsors may require an employee to repay the full outstanding balance of a loan if he or she terminates employment or if the plan is terminated. 0 fee for changes made to existing Direct Debit installment agreements.

This monetary assistance can be a great help to. If the year of repayment is 2019 and youre taking the credit enter the credit on Schedule 3 Form 1040 line 12 and see the instructions for it. As of January 2018 borrowers with IRS repayment agreements can qualify for a Fannie Mae conforming loan.

The LRP funds IHS clinicians to repay their eligible health profession education loans up to 40000 in exchange for an initial two-year service commitment to practice in health facilities serving American Indian and Alaska Native communities. Apply revise by phone mail or in-person. The IHS Loan Repayment Program LRP can help dedicated health professionals like you chart a course for a long-lasting and successful health care career.

The IRS has released final regulations on the extended rollover period for qualified plan loan offset amounts QPLOs. This can occur for example when a participant with an outstanding loan requests a distribution or terminates employment with the employer maintaining the plan and the loan terms require accelerating repayment or treating the loan as in default. Each payment should include an allocation of principal and interest.

Student loan repayment benefit means the benefit provided to an employee under this part in which an agency repays by a direct payment on behalf of the employee a qualifying student loan as described in 537106b previously taken out by such employee. Section 2202 of the CARES Act permits an additional year for repayment of loans from eligible retirement plans not including IRAs and relaxes limits on loans. If method 1 results in less tax deduct the amount repaid.

10 fee which may be reimbursed if certain conditions are met. The loan terms should require the participant to make level amortized payments at least quarterly. See details of conforming loan amounts in this blog post Fannie Mae is a government-sponsored enterprise GSE that purchases existing mortgage loans from lenders.

Be Reasonable with Rates and Repayment The IRS mandates that 401 k loans must be secured and that the interest rate and repayment schedule are commercially reasonable ie no worse than youd get from a lender on the market. You can claim an American opportunity credit for qualified education expenses paid with the proceeds of a loan. Section 172 p-1 QA-3.

Certain loan repayments may be delayed for one year. Loan repayments are not plan contributions. Education administers loan programs.

The loan must be repaid within five years unless the participant uses the loan to purchase his or her main home. Repayment of the loan must occur within 5 years and payments must be made in substantially equal payments that include principal and interest and that are paid at least quarterly. Education would service all borrower accounts.

Loans repaid by all methods other than wage withholding would be collected by Education.

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Irs Ruling Seen Opening Employer Plan Options For Student Loan Repayment Benefits Hr Daily Advisor

Irs Ruling Seen Opening Employer Plan Options For Student Loan Repayment Benefits Hr Daily Advisor

Your 1098 E And Your Student Loan Tax Information

Your 1098 E And Your Student Loan Tax Information

How To Qualify For A Mortgage With An Irs Repayment Plan Mortgage Blog

How To Qualify For A Mortgage With An Irs Repayment Plan Mortgage Blog

Irs To Issue Formal Guidance On Student Loan Repayment Programs Graydon Law

Irs To Issue Formal Guidance On Student Loan Repayment Programs Graydon Law

What Is The Irs Debt Forgiveness Program Tax Defense Network

What Is The Irs Debt Forgiveness Program Tax Defense Network

Https Home Treasury Gov System Files 131 Report Student Loan Repayments 1995 0 Pdf

Will Student Loans Take My Tax Refund During Covid 19 2021

Will Student Loans Take My Tax Refund During Covid 19 2021

Employer Student Loan Repayment Benefit Will You Get Tax Free Money

Employer Student Loan Repayment Benefit Will You Get Tax Free Money

Irs Courseware Link Learn Taxes

Irs Courseware Link Learn Taxes

Irs Missed 401 K Loan Repayments Can Be Made Up Without Being Taxed Hr Daily Advisor

Irs Missed 401 K Loan Repayments Can Be Made Up Without Being Taxed Hr Daily Advisor

![]() Should You Take Out A Personal Loan To Pay Your Taxes Mybanktracker

Should You Take Out A Personal Loan To Pay Your Taxes Mybanktracker

Student Loan Repayment Programs What Are They How Will The Irs Respond Bkd Llp

Student Loan Repayment Programs What Are They How Will The Irs Respond Bkd Llp

Irs Approves New 401 K Plan Design To Substitute Student Loan Repayments For Elective Contributions The Benefit Of Benefits

Irs Approves New 401 K Plan Design To Substitute Student Loan Repayments For Elective Contributions The Benefit Of Benefits

Popular Posts

I Think I Need To Go To A Mental Hospital

- Get link

- X

- Other Apps

Comments

Post a Comment